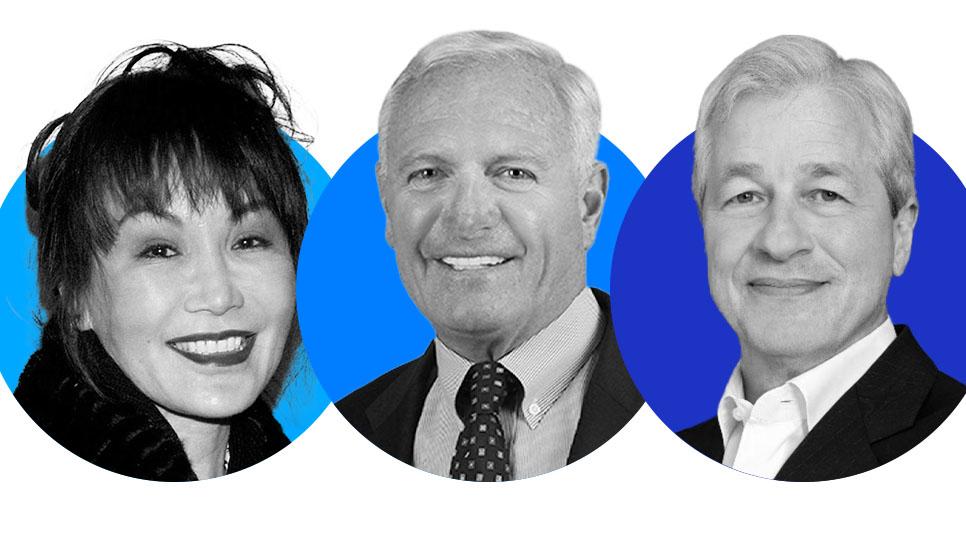

FB Roundup: Perrodo family, Haslam family, Jamie Dimon

Perrodo family receives $900 million energy windfall

In the wake of a surge in energy prices, the billionaire Perrodo family have benefitted from a $900 million bonus from their UK energy arm.

As quoted from Bloomberg, the family’s Perenco UK Ltd, a part of their international oil company Perenco, “paid them a total of £734 million in dividends between the beginning of 2022 and June of this year, according to a filing this month. The energy producer reported a 72% rise in comprehensive income last year to £547 million.”

The windfall, which dwarfs the family’s last reported payout of £100 million in 2019, is believed to have come from Perenco’s North Sea and Wytch Farm UK oilfields and the size of the premium is believed to be down to “a surge in prices after Russia’s invasion of Ukraine”, which is reflected in similar record profit reports from Exxon Mobil Corp and Shell plc.

Perenco was founded by Hubert Perrodo, who was the sole owner of the company until his death following a hiking accident in 2006. His wife, 72-year-old Singapore-born Ka Yee (Carrie) Wong Perrodo inherited the London-and-Paris-based oil and gas company after Hubert’s passing and their eldest son, 45-year-old Francois Perrodo, now chairs Perenco. His siblings Nathalie Samani, 41, and Bertrand Perrodo, 39, also stand to benefit from the dividends.

Solely owned by the Perrodo family (who have a collective net worth of $8.7 billion, according to the Bloomberg Billionaires Index), Perenco is one of the world’s largest private oil companies, with operations in Gabon, Peru, Vietnam and more.

Established in 1992 as a means to acquire oil and gas assets, Perenco now produces 500,000 barrels of oil a day, according to its website, of which about 40,000 barrels a day come from the UK.

“We want it to stay as a family business. It means we’re not looking for the growth, we’re not looking to pick up the share price,” said chief executive officer Benoit de la Fouchardiere in an interview. “If we have to stay at the size we are today, we’re more than happy to maintain this level of activity.”

The Haslam family sues Warren Buffett’s Berkshire Hathaway

After selling their Pilot Flying J truck stop chain to Warren Buffett’s Berkshire Hathaway, the Haslam family, headed up by Jimmy Haslam and his wife Susan ‘Dee’ Bagwell Haslam, are suing the ‘Oracle of Omaha’ and his holding company for “trying to artificially depress the price Berkshire Hathaway is obligated to pay for the family’s remaining 20% stake in the Pilot Travel Centers truck stop chain.”

Berkshire Hathaway boosted its overall stake in Pilot Flying J to 80% after purchasing an additional 41.4% for $8 billion in January 2023, following on from a previous purchase of 38.6% of shares in 2017. The Haslam family, meanwhile, retains control of day-to-day operations of the Tennessee-based firm founded by Jimmy’s father Jim Haslam in 1981.

However, the lawsuit put forward by the Haslams claims that Berkshire Hathaway is now “artificially depressing Pilot’s reported earnings, which are used to set the purchase price Berkshire agreed to pay in 2017,” according to a report by The Associated Press

“Berkshire is intent on using the accounting change to justify grossly underpaying Pilot (the Haslam family) for its 20% interest,” the lawsuit said.

As reported by Bloomberg, “Pilot Chief Legal Counsel Kristin Seabrook said in a prepared statement that this dispute isn’t related to the operation of the nation’s largest network of truck stops that has more than 850 locations and roughly 30,000 employees in the United States and Canada.”

“This legal dispute is limited to a narrow issue between owners and is in no way related to the management or day-to-day operations of Pilot Company,” said Seabrook referring to the ongoing operations of the firm which was formed by James Haslam II as Pilot Travel Centers in 1958 before merging the company with Flying J in 2001.

“The Haslams have the option once a year to decide whether they want to sell their remaining stake. The family asked the court to intervene and force Pilot to revert to the accounting method it used to use before they have to make that decision early next year.”

Jamie Dimon set to sell some of his JPMorgan shares

American billionaire chairman and chief executive officer of JPMorgan Chase, Jamie Dimon, has revealed that he will sell some of his shares in America’s largest bank next year after leading the multinational financial services firm since 2005

Forbes reports that Dimon will sell the stock for “financial diversification and tax-planning purposes” and “continues to believe the company’s prospects are very strong,” referring to a filing from the bank.

Dimon and his family intend to sell one million of their 8.6 million shares (less than 10% of Dimon’s holdings, which also include performance shares that have not vested and stock appreciation rights), valued by Forbes at $141 million. Dimon, who has an estimated net worth of $1.7 billion, previously warned that “this may be the most dangerous time the world has seen in decades”, despite JPMorgan Chase still reporting a 35% rise in profits and a market capitalisation exceeding $409 billion (according to London Stock Exchange Group).

A spokesman for JPMorgan Chase confirmed that Dimon’s share sale “is not related to leadership succession” and that he “has no current plans to sell more stock, but could consider doing so in the future” having previously signalled he could resign his role in around three-and-a-half years.