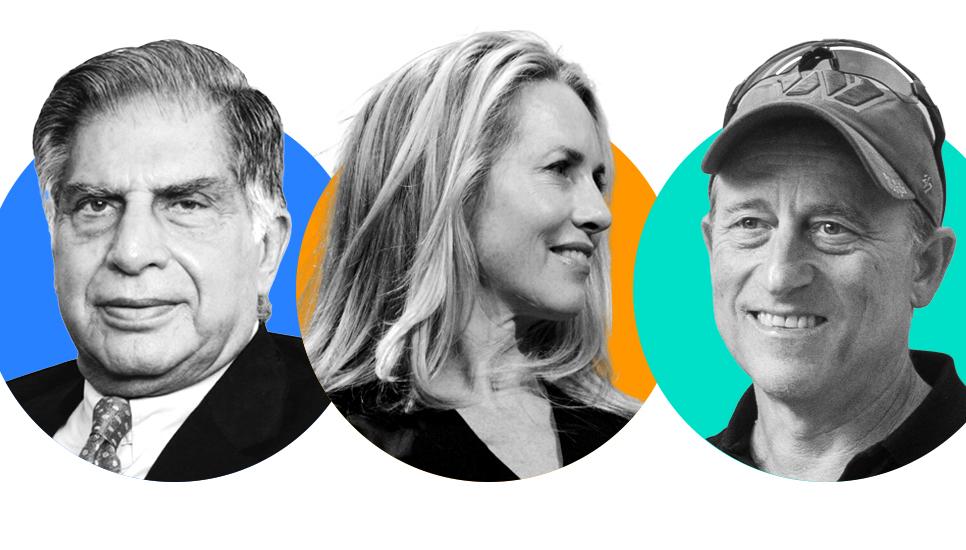

FB Roundup Ratan Tata, Laurene Powell Jobs, Josh Harris

Ratan Tata dies at 86

Ratan Tata, Indian industrialist and former chairman of the Tata Group, has died, aged 86 in Mumbai.

Following the news of his death, India’s Prime Minister Narendra Modi paid tribute to the man as “a visionary business leader, a compassionate soul and an extraordinary human being".

He was mourned internationally too. “I had the privilege of meeting him on several occasions, and I was always moved by his strong sense of purpose and service to humanity,” said Bill Gates, co-chair of the Bill & Melinda Gates Foundation.

“Together, we partnered on numerous initiatives to help people lead healthier, more prosperous lives. His loss will be felt around the world for years to come, but I know the legacy he left and example he set will continue to inspire generations,” he continued.

Under his leadership, Tata became one of India's most internationally recognised business leaders. The Tata Group is one of the country’s largest companies, with annual revenues of more than $100 billion.

The great-grandson of family founder Jamsetji Tata, he was born in 1937. He studied architecture and structural engineering at Cornell University in the US before joining Tata Industries – the promoter company of the group – as an assistant in 1962 and spent six months training at a company plant in Jamshedpur.

He was chairman of Tata Sons from 1991 until he retired in 2012. Under his leadership, the family business became truly global, with major blue-chip acquisitions including British tea brand Tetley, UK automaker Jaguar Land Rover and Anglo-Dutch steelmaker Corus.

A well-known philanthropist, he was named chairman emeritus of Tata Sons, Tata Industries, Tata Motors, Tata Steel and Tata Chemicals in 2012.

Laurene Powell Jobs backs Eleanor Health

Laurene Powell Jobs, who inherited her fortune from her late husband, Apple cofounder Steve Jobs, has backed the Series D funding for outpatient addiction treatment provider Eleanor Health.

Eleanor delivers in-person and virtual substance use disorder care, rooted in a harm-reduction clinical model. Eleanor’s clinical model includes Medications for Addiction Treatment, such as Suboxone and Vivitrol; psychiatry; therapy; and peer recovery coaching.

The company will use the $30 million it has raised to continue scaling its whole-person care model for substance use disorder, which has delivered improved clinical outcomes and total cost-of-care reduction across large populations.

“This funding represents a significant vote of confidence from our investors that our model works and our team is well positioned to scale that model across the country,” said William McKinney, chief executive of Eleanor Health. “By meeting people where they are, Eleanor’s approach opens the door for individuals to receive care who may not otherwise seek help, or who may face barriers that prevent their illnesses from responding well to traditional methods of treatment. We are thrilled to partner with investors that share our vision for transforming the way addiction treatment is delivered and paid for.”

The funding round was led by General Catalyst, with participation from existing and new investors including Town Hall Ventures, Echo Health Ventures, Northpond Ventures and Rethink Impact as well as Emerson.

Powell Jobs set up the Emerson Collective as an impact investor to focus on environmental justice, health, immigration and education.

In 2021 she launched the Waverley Street Foundation and committed to donate $3 billion over a decade to organisations addressing climate change through innovative solutions and environmental justice.

Forbes estimates her net worth to be around $15.1 billion.

Josh Harris’ 26North acquires Onelife Fitness

26North, owned by Josh Harris who co-founded alternative investment firm Apollo Global Management, has acquired health club operator Onelife Fitness from Delos Capital.

Financial terms have not been disclosed.

With locations across the Mid-Atlantic and Southeastern United States, Onelife Fitness is a high-value fitness club delivering a health and wellness experience with high-end amenities. Onelife Fitness currently has more than 400,000 members across 61 clubs, with plans for significant growth.

"Onelife is a fantastic opportunity to back what we believe to be a best-in-class operator and enduring platform in a growing category that is underpinned by a long-term consumer focus on physical fitness and wellness," said Mark Weinberg, 26North Partner and Head of Private Equity.

Jefferies LLC and North Point served as financial advisors to Onelife Fitness. Kirkland & Ellis served as legal counsel to 26North.

After meeting at investment bank Drexel Burnham Lambert, Harris co-founded alternative investment firm Apollo Global Management in 1990 with fellow billionaires Leon Black and Marc Rowan.

He stepped away from Apollo in 2021 and launched 26North in 2022.

"I am thrilled to return to my roots as an investor and entrepreneur with the launch of 26North and excited to reconnect with the many partners I've worked with over the last 30 years," he said at the time. "Investment performance starts with extraordinary people, and I feel grateful to have attracted such outstanding talent."

The firm launched with more than $5 billion in assets under management.

Harris is estimated by Forbes to have a net worth of $10.2 billion.