(Re)Generative: The New Saga of Family Businesses

- Ensuring successful generational transitions is a significant hurdle

- Regenerative family businesses have the potential to create a lasting positive impact on society.

- By focusing on sustainability, innovation, and strong family relationships, these businesses can thrive for generations to come.

Family businesses are the most widespread model in the world. From independent craftsmen to large multinationals, they represent nearly 70% of businesses worldwide.

This model presents a tremendous opportunity for our society as these families possess qualities that large corporations have long lost.

They have a long-term vision, allowing them to invest differently, both to innovate and in their people. They are generally more agile because they are not publicly traded, enabling them to navigate crises more calmly. And they have an entrepreneurial mindset that, if well-organised, allows them to move faster in innovation territories than their competitors.

Innovate to Stay Alive

Even though the numbers are not precise, it is often said that only about a third of these family businesses make it to the next generation, with only a few percent reaching the fourth. What we know for certain, demonstrated by various academics worldwide across all cultures and continents, is that those who repeatedly transition successfully to the next generation develop a distinctive entrepreneurial orientation each generation. This means the new generation can write their family's new narrative over a generation, free from the emotional pressure transmitted by the previous one: duty to the family, and guilt.

This implies several challenges:

- Being able to respond to the issues of their generation and avoid the trap of systematically duplicating what was done in previous generations, risking a lack of breakthrough innovation and gradually losing the entrepreneurial orientation of the initial generations.

- Clearly differentiating between the family business and the entrepreneurial family, as the greatest innovations can also come from outside the business through new family entrepreneurial projects, which must be possible within the family.

- Being able to finance these innovations.

All economic models are changing with global awareness of our consumption patterns. Family businesses must initiate this shift from an extractive model to a regenerative model if they wish to continue their family saga into the next generation.

The regenerative family model

How can an entrepreneurial family initiate this shift toward a regenerative culture?

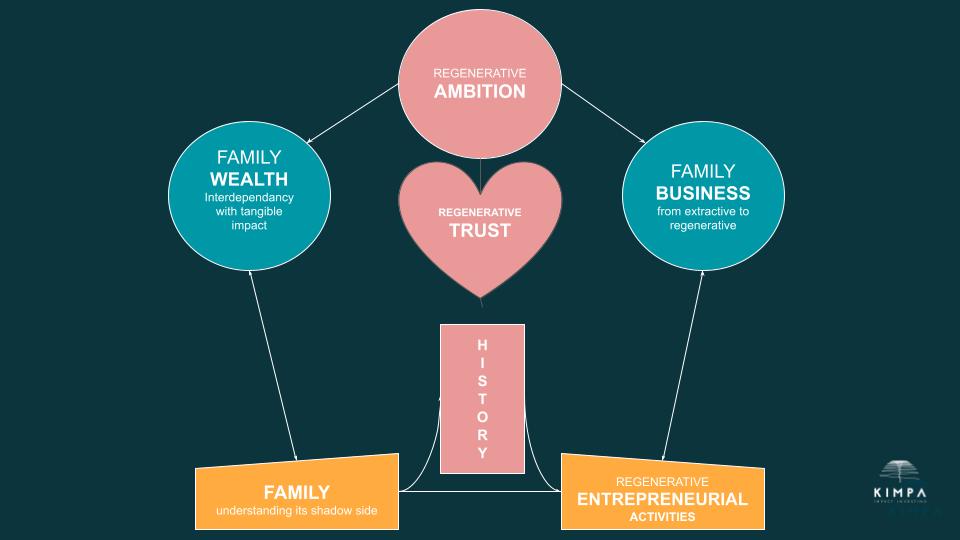

I propose this map to navigate through two parts:

- A backbone consisting of a head (family ambition), a heart (intrafamily trust), and a body (family history).

Action territories to engage the business and the family in this shift.

A regenerative backbone

Three circles are often mentioned to describe these entrepreneurial families: the business, the shareholders, and the family. These three circles are interdependent and, as generations pass, may experience divergences and conflicts of interest that necessitate building a robust backbone to ensure the family and the business grow together. This is what Randel Carlock described as the parallel planning process: professionalising the family as we have professionalised the business.

What is regenerative ambition?

Entrepreneurial families committed to transitioning from an extractive model to a regenerative one develop, in addition to financial capital, three other capitals:

- Reputational capital: The family name and their businesses impose a certain responsibility on the family regarding the decisions they make and their impact on their employees, markets, and customers. This reputational capital also brings a lot of trust from their stakeholders.

- Societal capital: This includes the family’s human capital composed of their employees, family shareholders, territorial anchoring, and engagements in civil society.

- Environmental capital: Structured around the 17 Sustainable Development Goals and planetary boundaries, this capital gradually integrates into the entrepreneurial family’s vision, ambition, and/or values.

One major challenge for entrepreneurial families is successfully navigating generational transitions. More than ever, to attract new generations to join the family movement, these families structure an ambition that distinctively integrates these four capitals into their project, especially if their initial model, built generations ago, comes from a particularly extractive and polluting industry: hydrocarbons, transportation, textiles, for example.

A few years ago, a fourth-generation hydrocarbon distributor family incorporated into their family vision: "Dare for positive impact" to attract the new generation to join the project. Four members of the fourth generation are now committed to transitioning this business.

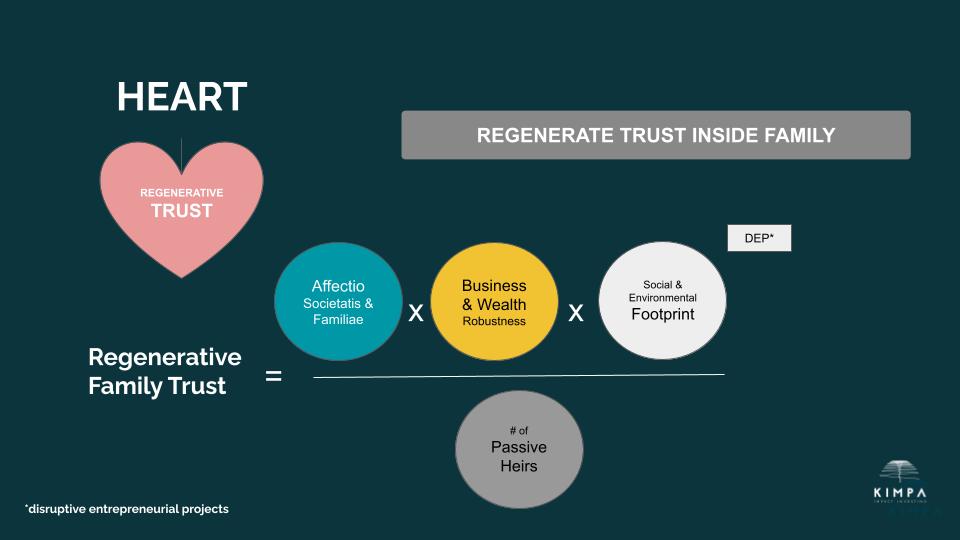

Family trust: a formula for trust

All companies work on their vision, ambition, strategy, and a good execution plan to succeed with the best possible team. Few work on trust, yet without trust, everything is more complicated and slower. Without trust, there is more control and less initiative and innovation. Entrepreneurial families are no exception; they must avoid creating passive heirs who live off the business’s dividends without being involved, putting significant pressure on the company’s management to ensure the continuity of dividend distribution, which can be delicate, if not dangerous, for the company at times.

The trust formula I propose incorporates three different energies:

- Emotional: To maintain and develop ties between family members and the family business.

- Robustness: Signifying the expected level of performance and sustainability from both the business and the family’s wealth. Both are necessary to relieve the business of the family’s burden and why this is essential to weather difficult times.

- Engagement: Understanding that the more a family develops passive heirs, the more it creates conditions for future failure.

These three energies are complementary and are diminished by a contrary force represented by passive heirs.

What is a passive heir?

A passive heir is a family shareholder who has no engagement in the family’s affairs, whether in the business circle, the shareholders’ circle, or the family circle. They need the dividends to live and may pressure the shareholders’ circle and the business if these dividends are reduced or suspended to address specific business needs: investment, crisis, etc.

The tendency to protect one’s descendants is natural but can become detrimental to the business, which is why the number of passive heirs decreases trust within the entrepreneurial family.

Fortunately, most family businesses have passive shareholders who do not pressure the business, having built income outside the business and are delighted that the family’s entrepreneurial project continues, giving their full trust to a cousin or sibling to carry on the adventure.

Family history

Family history is the body of the entrepreneurial family. Over generations, these families have built businesses but, more importantly, a reputation, a significant societal impact, and a responsibility to their employees and territories.

Regenerative families reflect on their family narrative to understand their roots, history, values, psychodynamic system, and how conflicts arise and are resolved. They project this narrative into the next 20 years to continue dreaming together with the new generation on board.

This is why history forms the body of these families. It characterises them and represents what their members have stood for, sometimes even through their public life engagements. It is not uncommon to see war heroes or political figures in these families.

It is also an opportunity to talk about love and family relationships. Is love conditional or unconditional in the family, conditional on engagement in the intergenerational project, for example?

Rediscovering one’s history and projecting the next family narrative is one of the best practices of a regenerative family.

Four action territories

These territories are all interdependent and need to be worked on in parallel with appropriate governance bodies to engage the family in contributing in the appropriate circles.

The family business: initiating the shift from an extractive to a regenerative model

This is the challenge for all companies in the 21st century. If they missed the digital revolution a few years ago and are still alive, they will not survive the sustainable revolution shaking all industries worldwide. Innovation challenges, governance, value sharing, and new business models are at stake, and appropriate governance is necessary, whether through a board of directors or a supervisory board. Qualified and relevant independent directors to challenge the company’s management with benevolence are a keystone of these family organisations.

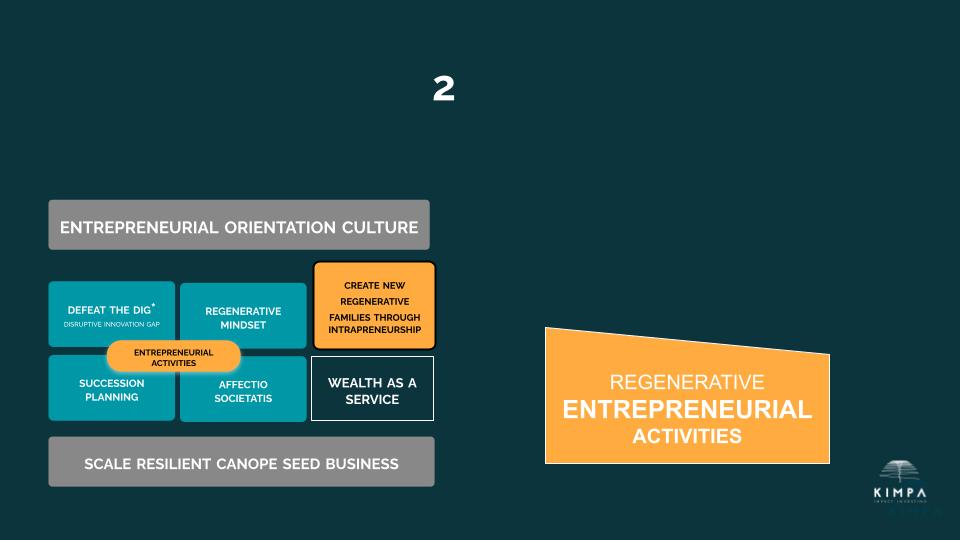

Entrepreneurial activities: how to stimulate the family’s entrepreneurial orientation?

It is a matter of survival. A distinctive entrepreneurial orientation in each generation is a MUST HAVE to succeed in intergenerational transitions. Unfortunately, this orientation tends to disappear or diminish significantly in entrepreneurial families that do not stimulate it. How? Simply by duplication. The innovative model of the first or second generation is duplicated in subsequent generations, in new territories or product ranges, but without breakthrough innovation. This leads to a decline in entrepreneurial orientation, sometimes over an entire generation, despite growing numbers due to previous generations' disruptive innovations. This is what I call the DIG: Disruptive Innovation Gap. It explains why, when the market moves and changes, the entrepreneurial culture disappears in some organisations. Developing entrepreneurial activities in a professionalised manner in the shareholder circle as well as the business circle is a good regenerative practice. Some invest in impact to take minority stakes in innovative companies related to their market or in new territories to develop this skill, which is not always held by the company's management team.

Innovating is one thing, but financing innovation is another, and it is one of the challenges for these entrepreneurial families.

Family wealth: from dependency on the family business’s success to interdependence with a tangible and measurable impact

Family businesses are often said to be more enduring over time, especially in times of crisis. This is mainly because they leave most of their earnings in the business and distribute less than others. This war chest sometimes constitutes a very significant cash reserve serving the business’s sustainability.

However, this creates a significant imbalance between professional and private wealth. This imbalance then creates a dependency on the family business, increasing emotional pressure on the family and a belief that ensuring the business’s sustainability means protecting and securing the family: emotionally and financially.

However, rebalancing private and professional wealth is one of the best practices of regenerative families as it separates family protection from the business’s success. Developing a wealth independent of the family business even becomes a competitive advantage as it allows the entrepreneurial family to support more entrepreneurial projects, especially outside the historic business, enabling the family to access other financing sources and engage in new family entrepreneurial projects, thus creating canopies of businesses that stabilise and sustain the family movement. Some families have developed galaxies of businesses that succeed in turn and help those going through crises to succeed.

Finally, it will be necessary to measure the impact of these investments, which is not as simple as it sounds but is a necessary condition.

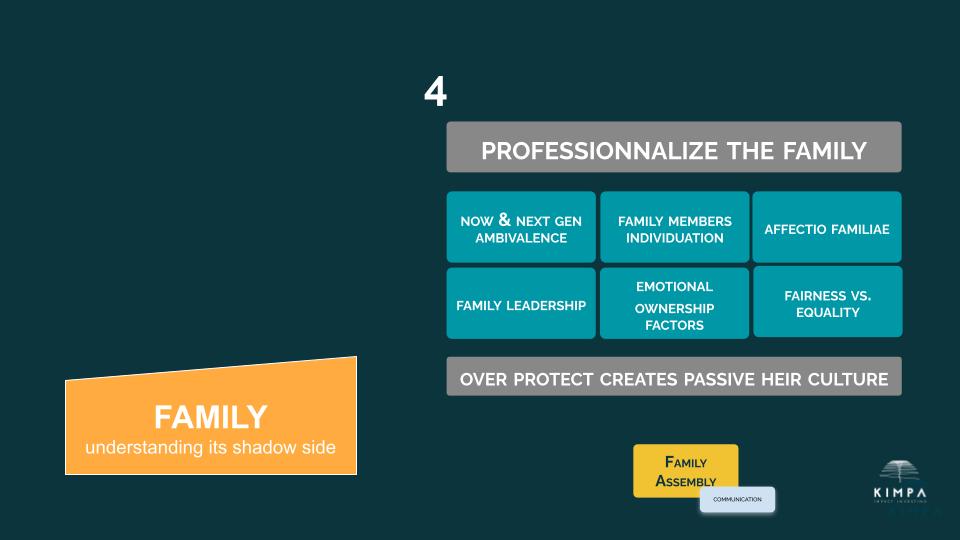

The family: understanding its shadow side

Business is complicated, but family is complex. So doing business as a family requires accepting its shadow side and engaging the family to professionalise to succeed through generations and avoid creating too many passive heirs, disengaged and a source of future difficulties, first emotionally, then financially, and sometimes legally.

Conclusion

Building a new narrative for your family for the next 20 years, addressing the planet's major challenges with the help of your entrepreneurial family and businesses, is a wonderful adventure. Trust is at its heart, ambition its head, and its narrative its body.

And you, what will be the new narrative for your regenerative family by 2050?