Data Centres: Better way to play AI?

- Since the beginning of 2023, AI-connected stocks have delivered 30% better returns than both US and global indexes, but our focus has shifted to the infrastructure that underpins AI.

- Exposure to data centres can be accessed as part of a diversified real assets portfolio, but there is scope to consider standalone data centre strategies.

- Investment in data centre strategies can offer higher returns given the favourable demand-supply imbalance seen in the market.

This document is issued by Isio Services Limited which is authorised and regulated by the Financial Conduct Authority (FCA), Firm Registration Number: 922376. This document is intended solely for distribution to Professional Clients for the purposes of the FCA's Handbook of Rules and Guidance and should not be relied upon by any other person.

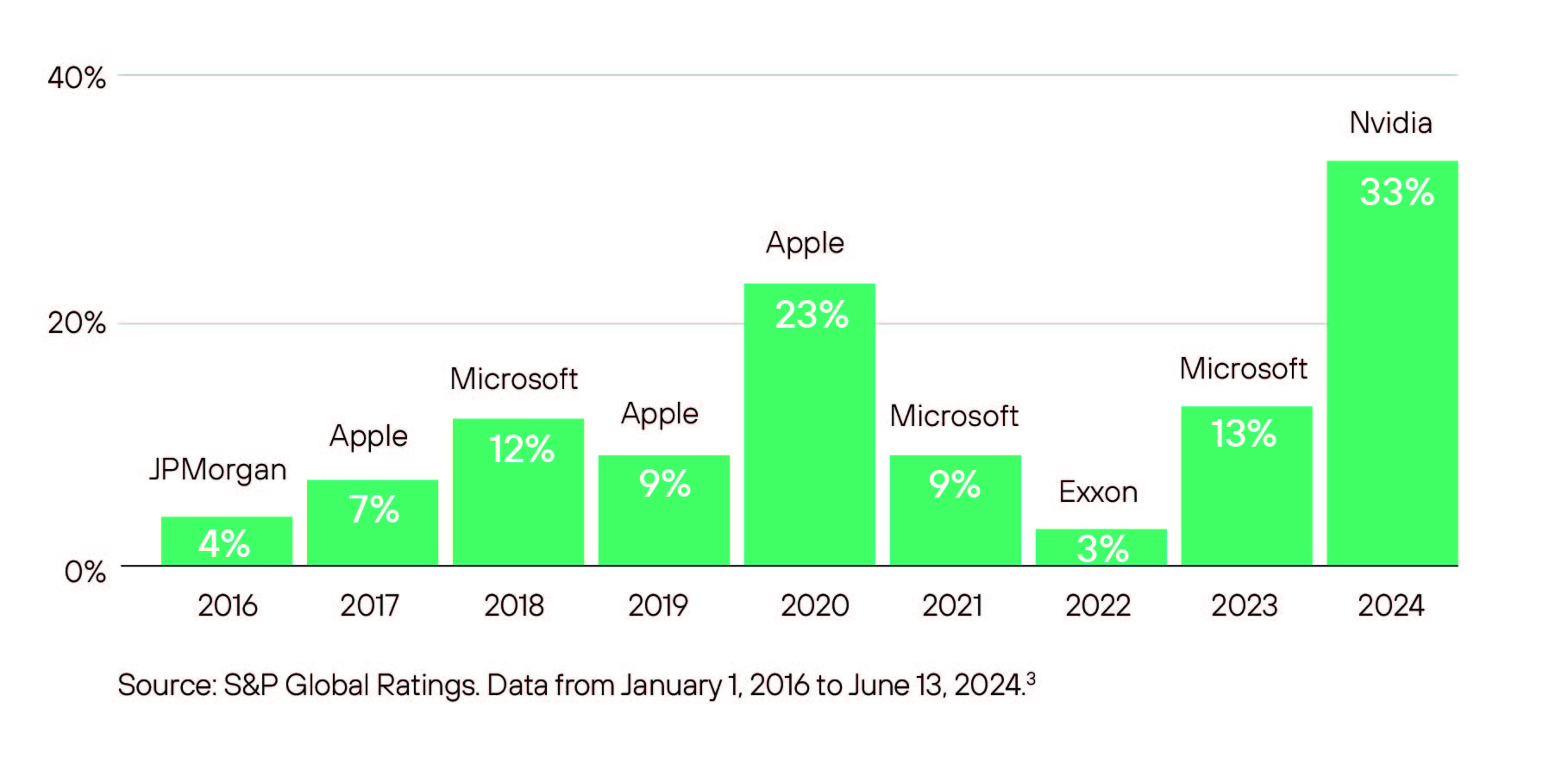

A lot of recent commentary within investment markets has revolved around how to best play the AI theme. Within listed equities, such unbridled enthusiasm for AI has led to a level of market concentration not seen since the 1970s, as a group of AI-exposed stocks dubbed the ‘magnificent seven’ dominated market returns in 2023. Since the beginning of 2023, AI-connected stocks have delivered 30% better returns than both US and global indexes, but we view the path forward as less clear given the difficulties in finding long-term winners within momentum-driven listed equity markets. Further to this, the early August market volatility has emphasised the unpredictability of listed equity markets and reinforces our view that a more balanced and nuanced approach will work better from here. As such, our focus has shifted to the infrastructure that underpins AI and identifying attractive investment opportunities within less liquid markets, which are fundamentally required for the development and support of the AI ecosystem. One such asset class we have identified as well placed to take advantage of the growing demands of AI is data centres.

What are data centres?

Data centres are the physical backbone of the internet and our digital lives.

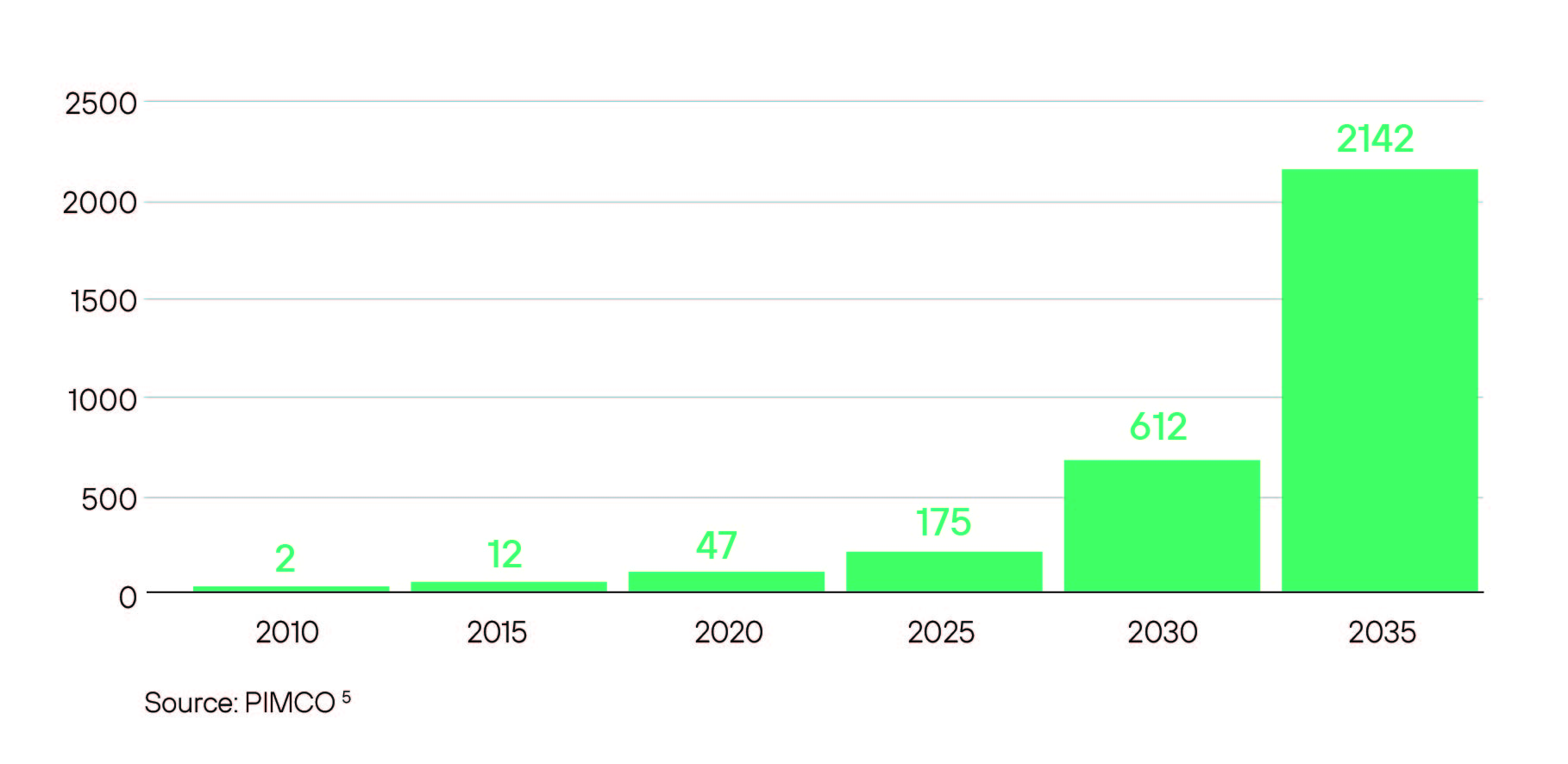

A data centre is a physical room, building or facility that houses IT infrastructure for building, running, and delivering applications and services, and for storing and managing the data associated with those applications and services. We are producing and consuming data at an exponential rate as shown in the graph below and we need more data centres to support this.

What are the types of data centre investment strategies?

While exposure to the data centre theme can be accessed as part of a diversified real assets portfolio, there is scope to consider standalone data centre strategies that can be offered through a real estate, infrastructure, or private equity lens.

Real estate data centre strategies have much more focus on the location and the physical asset and often target net returns between 14-16% per annum, through a combination of income from stable to increasing rents and elevated acquisition multiples on exit. The most common data centre real estate strategy is a build, fill and sell approach. This involves sourcing property opportunities based on market demand, establishing long-term leases with typically hyperscale tenants, before selling a stabilised data centre into strong market demand from income-seeking investors like REITs and private equity firms.

Infrastructure strategies have a greater focus on developing data centres and investing in data centre platforms. This could involve identifying development opportunities, where the emphasis is on securing and delivering uninterrupted electric power and meeting the specific technical requirements of large occupiers. Infrastructure data centre strategies often target net returns between 16-18%, driven by the diversified income stream from operations and development. Within infrastructure, it is important to look for data centre strategies with long-standing expertise and track records of dealing with tenant requirements and changing data centre formats. This is important given that infrastructure strategies provide a wider spectrum of data centre services related to the essential operation of the facilities, including the connectivity requirements of their tenants.

Managers can also take a private equity approach to data centres, where they would look to build out a data centre platform, with multiple data centres managed by a suitable management team, which they could then look to sell to bigger players and benefit from the platform premium. This approach can generate much stronger returns, though it comes with traditional private equity risks as well as data centre-specific risks. What we do not view as attractive is listed data centre REITs, given their greater allocation to legacy assets rather than new builds. Legacy data centres are at greater risk of no longer being suited for tomorrow’s computing needs and may not have the power sources in place to support tenant growth plans.

Who are data centre tenants?

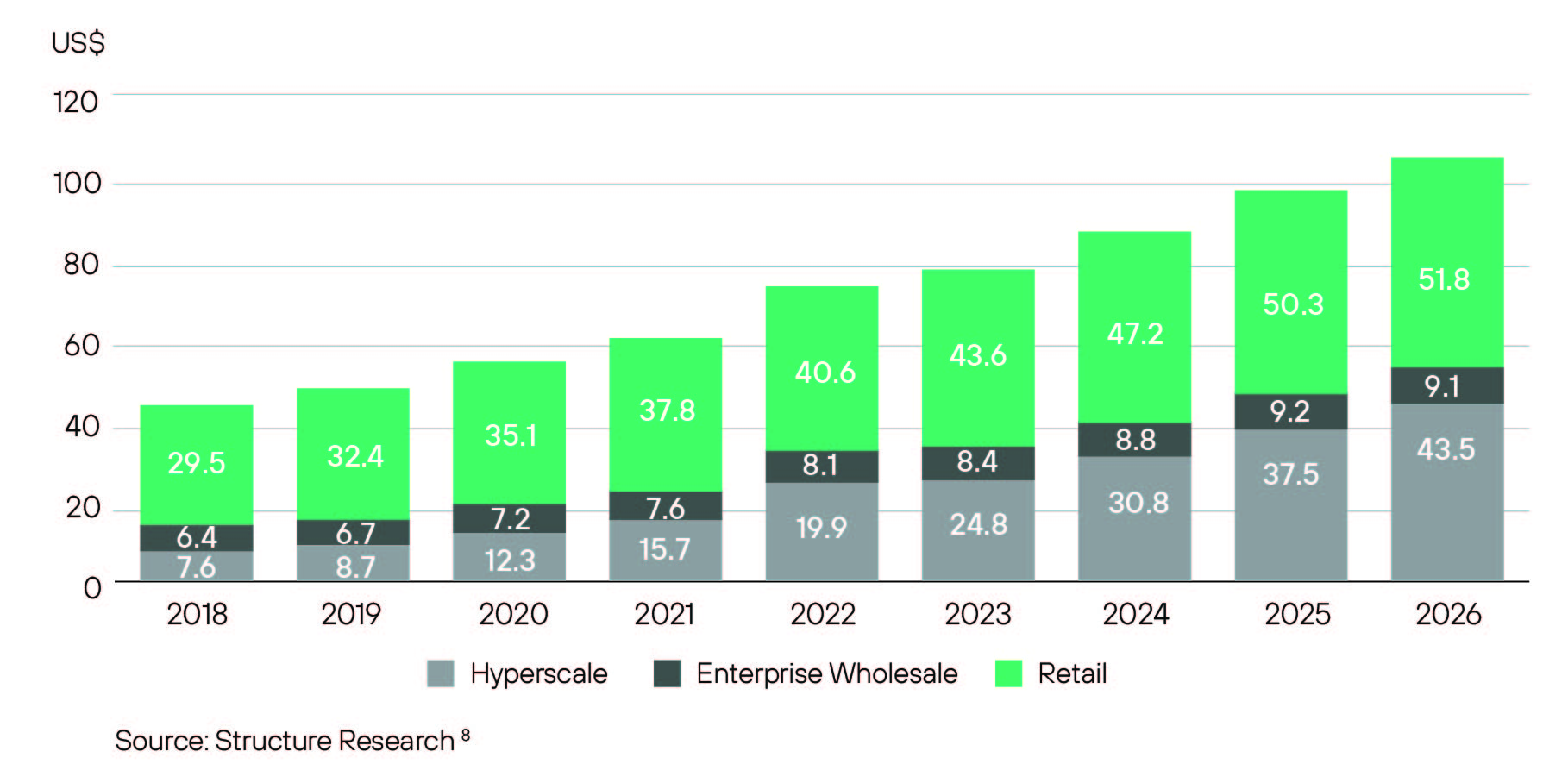

In terms of the tenants behind the demand for data centres, the three key players include enterprise users, co-location providers and hyperscale users.

- An enterprise data centre is a data centre owned and operated by a single organisation and is often built on-site, which allows for more control and visibility into operations. Enterprise tenants include companies such as Coca-Cola, JPMorgan and Walmart, who are large multi-national organisations, but require much less space than hyperscale tenants.

- Co-location providers are companies that provide cloud services on a smaller scale than what hyperscale users require and operate under either a wholesale or retail model. Retail tenants are those looking for smaller spaces/ power commitments and often share space with other customers. Wholesale tenants have larger power requirements and tend to own their own data centre equipment.

- Hyperscale users are the largest and fastest-growing tenant group, and they include large technology (AWS, Google, Microsoft, etc) organisations that require large amounts of capacity and expansion potential and prefer long-term leases. Our preference is for data centre strategies that allocate to hyperscale tenants, given their growth potential and the fact that they tend to have very high credit ratings, making them high-quality tenants.

Why invest in data centres?

Data centres are essential assets that provide society with the digital interconnectivity critical for economic growth and we have summarised the key benefits below:

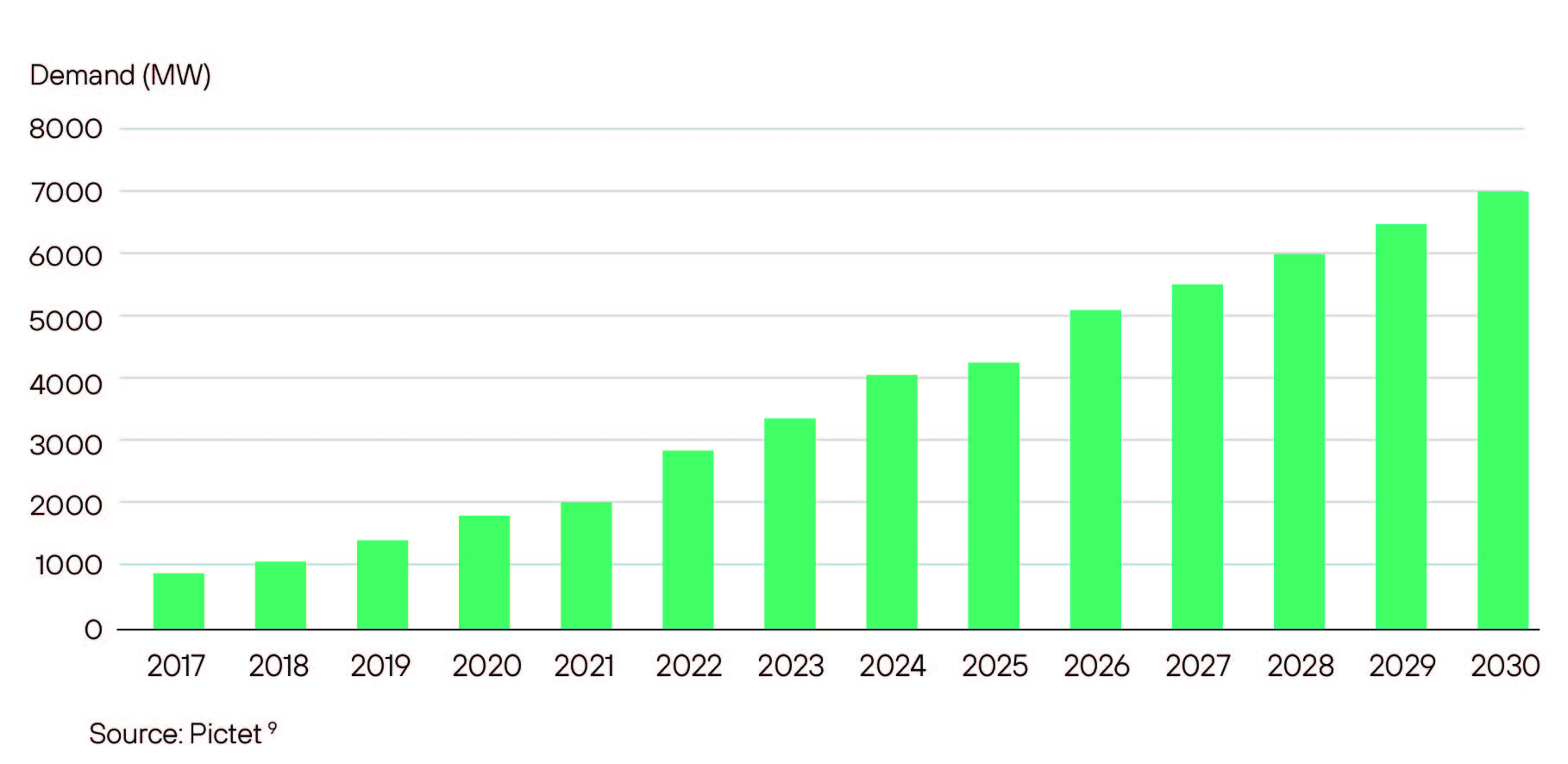

- Investment in data centre strategies can offer higher returns given the favourable demand-supply imbalance seen in the market. Expansion of AI products and the cloud has exacerbated demand requirements, while supply remains weak due to data centres being a highly specialist asset class, requiring expertise in site selection, equipment and build-for-purpose approach.

- Data centres can provide high, long-term and predictable revenue streams, with strong exit routes through hyperscalers or core infrastructure funds/investors.

- Tenant leases can provide robust, contractual, and long-term income and can have direct inflation exposure where rental increases are uplifted by inflation.

- Data centre strategies can provide a complimentary exposure to traditional real estate/infrastructure investments, as they are designed to produce returns primarily from rental payments (based on power capacity rather than traditional leases) and asset sales.

What are the key considerations?

Lack of available power (and fluctuations in cost) and supply chain delays are data centre specific risks that must be mitigated by operators.

Given the ever-continuing technological progression in computer hardware and software, there is technological obsolescence risk in the computing and storage elements of a data centre.

Greenhouse gas emissions and water consumption for cooling all present challenges from a sustainability perspective, given increasing ESG regulations. Accessing clean energy is an issue and data centres are facing pressure to shift to renewable power sources and secure carbon-free energy supplies.

What does this mean for you?

We view data centres as offering an attractive long-term alternative investment opportunity that benefits from exponentially increasing demand, in the midst of a digital transformation.

As such, there is a strong potential for sizeable returns, dependent on the approach taken and strategy invested in. However, given data centres are positioned within a fast-moving and complicated landscape, there are technological, regulatory and ESG requirements that need to be considered. In such a situation, the importance of partnering with the right expertise to sift through the various data centre options cannot be understated. Isio is an independent adviser, with no third-party compensation, no product, and no hidden agenda. Rather, Isio only works for our clients and excels at bringing the right strategy, ideas and investments that meet a client’s objectives at the right time. Often investors are sold products or advised from the platform that the distributor has to offer, which is frequently inappropriate.

Contact Rob Agnew, Partner, isio Private Capital rob.agnew@isio.com for more information.

The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.