Diversification and a hedge

- Gold reduces overall portfolio risk and increases stability, especially during market volatility.

- Gold is a hedge against inflation. It protects wealth from the erosive effects of inflation.

- SOLIT provides secure wealth management through physical bullion ownership outside the banking system.

Gold has performed well in 2024, rising by 12% year to date. What is your outlook for gold in the short to medium term?

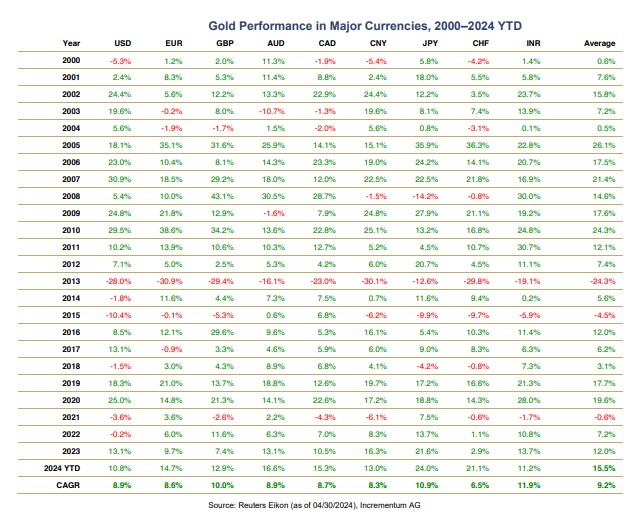

Thomas Sowell once said: “One of the biggest taxes is one that is not even called a tax – inflation”. When looking at gold in different currencies we see how the inflation-induced loss in purchasing power can be smartly set off. This counts not only for 2024 but for decades.

You don´t have to be a prophet to grasp that it is highly likely, that we will see gold continuing this way which means there will be rising gold prices in the short and middle term due to several factors.

One is still quite underestimated by many: the demand coming from emerging markets Some analysts even say, gold equals a low beta proxy on emerging markets. According to the research of the WGC and Incrementum, gold jewellery demand in 2023 totalled 2092 tonnes, of which 562 t was from India, 630 t from China, and 171 t from the Middle East. That’s 65% of the total from these three markets. Likewise, of the 1,189 t of gold bar and coin demand in 2023, the three largest components were from China (279 t), India (185 t), and the Middle East (114 t), which together accounted for nearly half of the total. Central banks are also an important factor here. In 2023, for example, they bought more than 35% of the total year supply. In addition, interest rates, inflation, and geopolitical instability are without doubt the key variables in central bank portfolio management. Gold has always been a great risk diversifier for central banks. According to WGC data, nearly two-thirds of surveyed central banks expect the share of gold in global reserves to rise from 15% to 16-25% over the next five years. Among the central banks of the emerging market and developing economies (EMDE), the figure is almost 70%.

High price targets in the ballpark of $5,000-$10,000 are not out of the question as we have seen impressive magnitudes of increase here in the past (e.g. when gold went from $300 to $1,900 in the decade from 2001 to 2011 or when it went from $35 an ounce in 1970 to $800 in 1980).

Inflation and lower interest rates could have an important impact in the coming months. Investors will soon start to realise that higher inflation numbers don´t mean that the FED has to fight harder to win the race, it means they have already lost the race and inflation has won.

The FED is very political. When it has to pick its poison it will pick inflation, and once the markets realise that that is where we are going, gold is going to be off to the race.

How should wealthy families be looking at gold as an asset class?

Wealthy families may consider gold as an asset class for diversification and as a hedge against economic uncertainty. Gold is often seen as a safe haven asset that can help protect wealth during times of market volatility or inflation. It can also provide a store of value over the long term.

When considering gold as an asset class, wealthy families should assess their overall investment goals, risk tolerance, and time horizon. They may choose to allocate a portion of their portfolio to gold to reduce risk and enhance diversification. It’s important to note that while gold can be a valuable addition to a portfolio, it does not generate income like stocks or bonds. We think that this is one of its best qualities as it has no counterparty risk while being a perfect store of value.

We recommend that wealthy families work with financial advisors or wealth managers who have excellent knowledge of the bullion sector to determine the appropriate allocation of gold within their overall investment strategy. Additionally, they should stay informed about market trends and factors that may impact the price of gold in order to make informed decisions about their investments.

Is the exposure of Family Offices to gold too low?

The exposure of Family Offices to gold can vary depending on their investment strategy, risk tolerance, and overall financial goals. Some Family Offices may have a low exposure to gold as they prioritise other asset classes such as stocks, bonds, real estate, or alternative investments. However, there are solid arguments for increasing exposure to gold in a portfolio.

Gold is often considered a safe haven asset that can provide diversification and act as a hedge against economic uncertainty, inflation, and market volatility. In times of crisis or when traditional assets are underperforming, gold has historically shown resilience and maintained its value.

Family Offices may consider increasing their exposure to gold if they are seeking to reduce risk in their portfolios or protect wealth during turbulent times. It can be a valuable addition to a well-diversified investment strategy.

Ultimately, the decision on the appropriate level of exposure to gold should be based on each Family Office’s unique financial situation, investment objectives, and risk tolerance. Working with financial advisors or wealth managers like SOLIT can help Family Offices determine the optimal allocation of gold within their overall investment portfolio.

Why is gold the missing piece in wealth management?

Gold is often considered the missing piece in wealth management for several reasons:

Diversification: Gold has a low correlation with other asset classes such as stocks and bonds, making it an effective diversification tool. Including gold in a portfolio can help reduce overall risk and increase stability, especially during times of market volatility.

Hedge against inflation: Gold is often seen as a hedge against inflation, as its value tends to rise when the purchasing power of fiat currencies declines. By holding gold, investors can protect their wealth from the erosive effects of inflation.

Safe haven asset: Gold is considered a safe haven asset that tends to perform well during times of economic uncertainty or geopolitical instability. It can provide a store of value and act as a financial insurance policy in turbulent times.

Long-term store of value: Gold has maintained its value over centuries and is not subject to the same risks as paper currencies or financial assets. As a tangible asset with intrinsic value, gold can serve as a long-term store of wealth.

Portfolio protection: Including gold in a wealth management strategy can help protect against systemic risks in the financial system, such as currency devaluation, banking crises, or stock market crashes.

Overall, gold can play a valuable role in wealth management by providing diversification, hedging against inflation, serving as a safe haven asset, maintaining long-term value, and protecting portfolios from various risks. Incorporating gold into a wealth management strategy can help investors achieve greater resilience and stability in their overall financial holdings.

Where does it fit in an investment portfolio? Is it an alternative, commodity or instrument to manage risk?

Gold can fit into an investment portfolio in various ways, depending on the investor’s goals and risk tolerance. It can be considered as an alternative investment, a commodity, and a risk management instrument:

Alternative Investment: Gold is often categorised as an alternative investment because it has unique characteristics that differentiate it from traditional asset classes like stocks and bonds. Including gold in a portfolio can provide diversification benefits and reduce overall portfolio risk.

Commodity: Gold is a precious metal that is mined and traded like other commodities such as oil or silver. As a commodity, gold can be influenced by supply and demand dynamics, geopolitical factors, and macroeconomic trends. Investors can gain exposure to the price of gold through various financial instruments such as futures contracts or exchange-traded funds (ETFs). But these are mere paper investments which means you get some exposure to the gold price but not necessarily to real gold. If there is a demand shock or a buying panic and the prices are skyrocketing, that is exactly when these paper contracts are going to fail. This is why we highly recommend direct physical ownership and a smart storage and liquidity concept.

Risk Management Instrument: Gold is commonly used as a risk management tool in investment portfolios. It is often seen as a safe haven asset that tends to perform well during times of market stress or economic uncertainty. By holding gold, investors can hedge against inflation, currency devaluation, and systemic risks in the financial system.

In summary, gold can serve multiple roles in an investment portfolio: as an alternative investment for diversification, a commodity for exposure to price movements, and a risk management instrument for protecting against various risks. The decision to include gold in a portfolio should be based on the investor’s financial objectives, risk profile, and overall investment strategy. Consulting with a financial advisor or wealth manager like SOLIT can help determine the appropriate allocation of gold within an investment portfolio.

How can SOLIT help Family Offices? What is SOLIT’s story?

We focus on securing wealth through private ownership of physical bullion outside the banking system. Our services are based on the trusted and individual care of an exclusive international clientele. For over 15 years, SOLIT Group has set the standard for

professional advisory services in the precious metals sector by offering tailored, individual solutions for international clients. Our extensive experience and expertise make us a strong Trusted Advisor for individual investors, families, companies, and foundations.

Our global clientele benefits from comprehensive solutions developed and implemented by our renowned Wealth Management experts. We understand the unique needs and requirements of each client and offer individual strategies tailored to their specific goals and asset structures.

Your Contact Persons for SOLIT's International Advisory and Individual Solutions Services:

Dr. Oliver Wilhelm, Global Head Advisory and Individual Solutions (based in Germany)

Frank Schulze, Global Head Advisory and Individual Solutions (based in Switzerland)