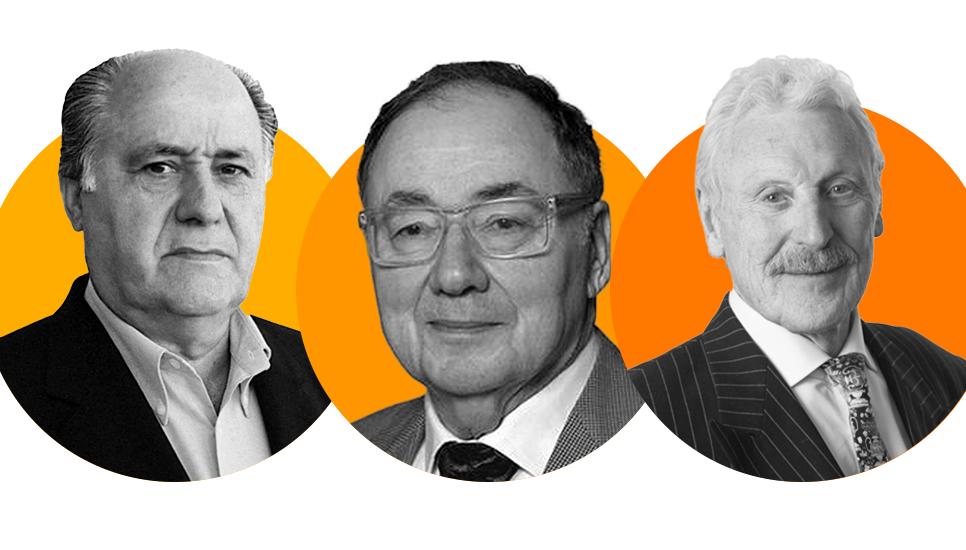

FB Roundup: Amancio Ortega, Barry Sherman, John Whittaker

Amancio Ortega leans into ‘buy the dip’ strategy with discounted real estate grab

Pontegadea, the family investment vehicle of Spanish billionaire Amancio Ortega, is reportedly taking advantage of the commercial property downturn by buying bargain assets. The founder of fashion giant Inditex is expanding his real estate holdings via a “buy the dip” strategy, via his €90 billion-plus personal investment group.

“The Spanish fund, which owns 59 per cent of Zara’s parent company Inditex, has in the past year announced ten acquisitions worth €1.1 billion spanning logistics, offices and residential property,” according to a report by The Financial Times.

“Because Pontegadea is awash with dividends from its Inditex stake and does not need to take on debt, it has been unaffected by the high interest rates that have pushed transaction volumes down by more than 50 per cent in the US and Europe in the past year.”

The founder of the global fashion retailer, which counts Zara, Pull&Bear, Massimo Dutti, Bershka, and others amongst its brands, Ortega has been on a real estate tear over the past few years with a growing portfolio of properties in western Europe and North America, including Devonshire House in London, Meta Platform’s headquarters in Seattle, Manhattan’s Haughwout Building and the 45-storey 727 West Madison in Chicago.

Roberto Cibeira, Pontegadea’s chief executive, told The Financial Times the group had observed “a price adjustment in Europe across asset classes” in the past few months.

“We believe this is a good time for investors with low debt given the tightening of credit conditions, which is reducing competition for potential acquisitions of a reasonable size.

“In Pontegadea’s case, we are being offered assets in bilateral processes and in many cases off-market [before they are advertised publicly] - specifically in logistics, retail, offices and infrastructure.”

The 87-year-old Ortega, who is Spain’s wealthiest person with a $98.8 billion fortune (according to Forbes), also has interests in infrastructure with a stake in an undersea telecoms cable company, electricity and gas networks in Spain and Portugal, and a renewable energy project with global power firm Repsol.

The family of Barry and Honey Sherman argue in lawsuit over a trust payout

The niece and nephew of murdered billionaire Barry Sherman and his wife Honey are suing their other heirs over a trust they say may be worth more than $500 million, according to a report by Bloomberg.

Barry Sherman, the founder of drug giant Apotex, and his wife were among Canada’s richest people and were well-known philanthropists, donating to hospitals, the University of Toronto and other causes. They are believed to have been killed in their Toronto home on December 13, 2017, in a “targeted” double homicide, after police initially believed the deaths to be a murder-suicide.

With a net worth of around $3.6 billion at the time of their deaths, the case remains unsolved to this day.

Now, Matthew and Rebecca Shechtman (the children of Mary Shechtman, the sister of Honey Sherman) are reportedly “taking legal action against their cousins, Sherman’s children, as well as other family members and the administrators of the trust, according to documents filed with the Ontario Superior Court of Justice in Canada. They claim the administrators breached their fiduciary duties by refusing to share information on the trust and are asking the court to appoint new trustees.

“According to the lawsuit, which was filed last month and reported over the weekend in the Toronto Star, Barry Sherman established the trust in 2016 to benefit his four children, along with those of Mary Shechtman and of Sandra Florence, his own sister.

“The trust’s main assets were shares in a holding company called Shermco, which was meant to ‘capture the growth in the value of Sherfam Inc. from 2016 forward,’ according to the lawsuit. Sherfam is the family’s main holding company, which once encompassed Apotex Inc., the pharmaceutical manufacturer that constituted the bulk of Barry Sherman’s net worth.”

The Whittaker family garners £22 million in dividends as Peel Ports profits rise

Peel Ports, Britain’s second largest port operator, has reported a £88.9 million dividend payout to its investors, £22 million of which has been awarded to its founding family, after a successful 2022.

Yahoo! Finance reports that “Companies house filings show earnings before interest, depreciation and amortization (EBITDA) increased from £299.7 million to £330.9 million in the 12 months to March, despite industrial action at the Port of Liverpool and global disruption created by the War in Ukraine.

“Turnover also improved, particularly in the group’s shipping segment, which saw revenues increase by 48.2 per cent as a result of higher charter and bunker rates. Group operating profit increased by nearly a fifth to £228.1m.

Founded by billionaire investor John Whittaker, Peel Ports forms part of The Peel Group, a large British conglomerate that holds stakes in property, media and infrastructure businesses.

The Lancashire-born businessman got his start in the 1970s acquiring cotton mills for their land and built up Peel Holdings in the 1980s by buying up a string of companies. He has since garnered a reputation for his many regeneration projects around the UK, including Manchester’s MediaCityUK and Trafford Centre mall. Peel Port’s operations, of which the Whittaker family owns 37.6 per cent (and an overall 68 per cent stake in the Peel Group), cover London, Liverpool and Glasgow.

“The growth in EBITDA reflects another strong year against the backdrop of challenging economic conditions,” said a spokesperson for Peel Ports. “This continues our record year-on-year growth, in which we consistently outperform the market.

“As a major port operator focused on long-term sustainable growth, every year we re-invest a significant proportion of our earnings back into the business to enhance our operational capability and future business potential.

“This investment supports the regional economies in which we operate whilst opening new trade opportunities for UK businesses, creating quality employment opportunities and driving forward our carbon neutral agenda.”