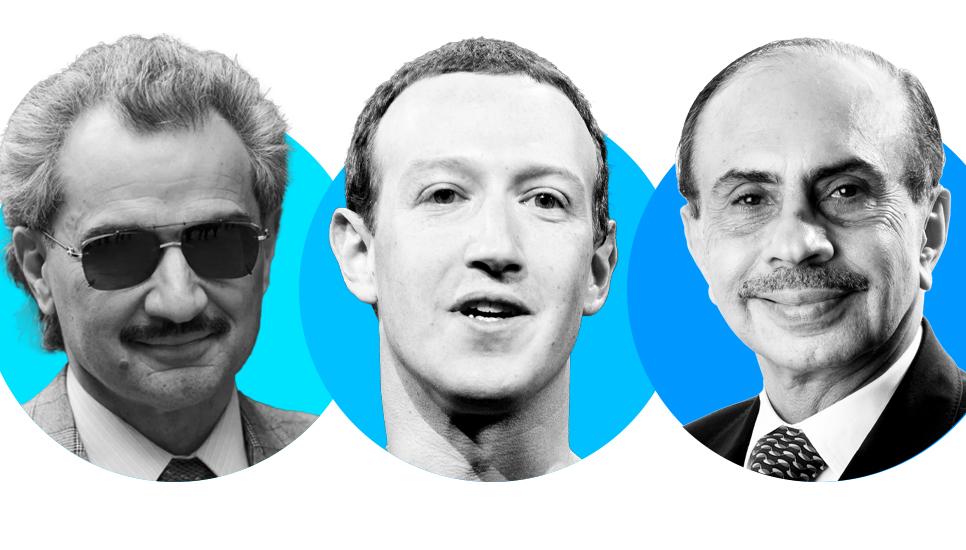

FB Roundup Godrej family, Alwaleed bin Talal, Mark Zuckerberg

Godrej family sells down stake in Sobha

The Godrej Industries Group’s family office arm Anamudi Real Estates has sold down 4.4% of its stake in real estate firm Sobha.

It sold its 4.4% stake at an average price of Rs1,810.44 per share, giving a transaction value of Rs8.6 billion ($102.7 million).

Headed by PNC Menon, Sobha Group was founded in 1995 and has a property business in both Dubai and India. In Dubai, it is called Sobha Realty, while in India it is Sobha Ltd.

Sobha is the third largest real estate player in India. In May this year, it reported its strongest results so far with annual sales of Rs66.4 billion.

“Financial year 2023-24 was an exceptional year for Sobha with best-ever sales, collections, new project launches and an increased pace of project completions in the real estate segment,” said Jagadish Nangineni, Managing Director of Sobha.

Godrej maintains a 9.99% stake in the group after the sale. The Business Standard newspaper reports that Godrej returned a 10-times multiple of the original investments, including dividends over a four-year holding period.

The report continued that divestment is part of its strategy to monetise investments.

Worth an estimated $16.7 billion according to Forbes, the Godrej family controls the Godrej Group, one of the country’s largest consumer and industrial products companies.

Established by Ardeshir Godrej in 1897, the current head of the family is Adi Godrej who took over in 2000.

Alwaleed bin Talal’s Flynas acquires 160 New Airbus Aircraft

Saudi Arabia’s low-cost airline Flynas has signed an agreement with Airbus to acquire 160 new aircraft. This order, comprising 30 wide-body A330neo aircraft and 130 narrow-body A320 family aircraft, doubles Flynas’s total orders to 280 aircraft.

Flynas is backed by high-profile Saudi Arabian investor Alwaleed bin Talal who owns his stake in the airline via Kingdom Holding. His investment vehicle also includes stakes in ride-sharing firm Lyft, Citigroup, hotel management company Four Seasons Hotels & Resorts, the Hotel George V in Paris and the Savoy Hotel in London.

A minority 5% stake in Kingdom Holding is listed on the Saudi Stock Exchange while he holds the remaining 95%.

The Flynas agreement was signed at the Farnborough Airshow in London last week.

Flynas Chief Executive and Managing Director Bander Almohanna highlighted the strategic importance of the deal. “This agreement to purchase 160 Airbus aircraft reinforces our determination to establish Flynas as a leading global low-cost carrier. By doubling our order volume to 280 Airbus aircraft, we ensure sustainable growth across our network of regional and international routes, spanning short, medium, and long-haul flights,” he said.

“Notably, this is our first order for the wide-body A330neo with Airbus, with deliveries starting in 2027. This will enable us to explore new long-haul markets, offer more seat capacity, with diverse and innovative products to our passengers,” he continued.

Last year, during the 2023 Paris Air Show, Flynas signed an agreement with Airbus for 30 additional A320neo aircraft as part of fleet expansion from the previous order for 120 aircraft that was signed in 2016. Currently, Flynas operates over 70 domestic and international routes with more than 1500 weekly flights and has served over 78 million passengers since its launch in 2007.

Alwaleed bin Talal is estimated by Forbes to be worth around $18.7 billion.

Mark Zuckerberg-backed DeepL pushes into Chinese market

German AI translation startup DeepL, which is backed by Mark Zuckerberg’s family office, is pushing into the Chinese market with the capability to translate Mandarin.

Traditional Chinese plays a significant business role on a global scale – serving as the primary form of written communication in key business markets such as Taiwan, Hong Kong, and Macau. “We understand the importance of these regions in global trade,” says Jarek Kutylowski, Chief executive and Founder of DeepL. “The addition of Traditional Chinese not only enables companies in these regions to expand globally but also provides ample opportunities for companies looking to enter some of Asia’s most impactful markets.”

DeepL has already launched translation capabilities in Korean and Japanese.

A 2024 Forrester study suggested that implementing DeepL delivered a 345% return on investment for global companies, reducing translation time by 90% while driving a 50% reduction in workload.

More to the point, the language translation market today is vast, $69 billion and, many say, ripe for disruption. Estimates are that machine-based translation constitutes just $1.2 billion of spend but is expected to grow at a CAGR of 20% to $4 billion by 2030.

Iconiq Growth, a fund from Mark Zuckerberg’s family office, took a stake in DeepL in May.

“A lot of value in the translation market resides in more long-form and technical translations, which have historically been more challenging to automate with human-like quality. Since launching seven years ago with a singular focus on language solutions, DeepL is able to tackle these complex use cases with paramount quality and accuracy which has been a true point of competitive differentiation,” said Iconiq Growth in a statement.

The size of Iconiq’s stake has not been disclosed.