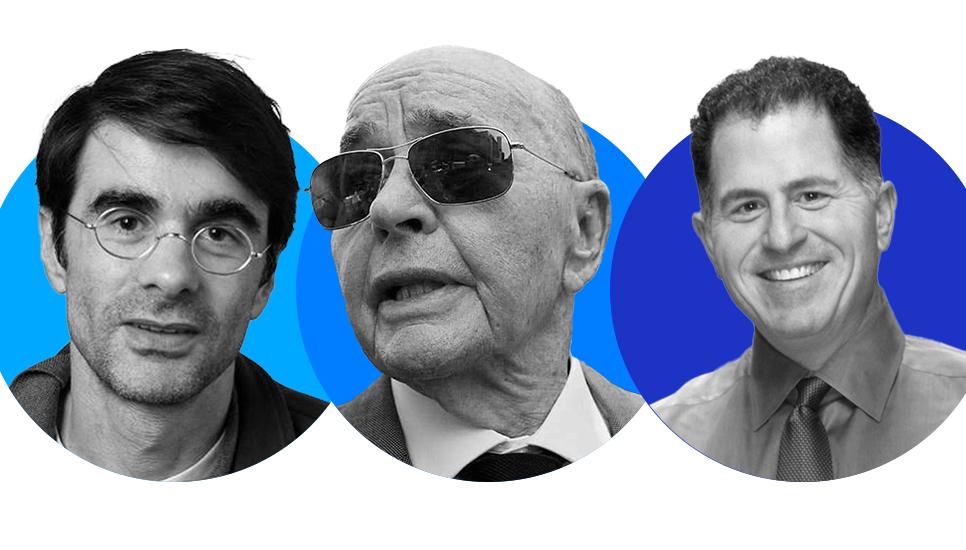

FB Roundup: Joao Moreira Salles, Joe Lewis, Michael Dell

Moreira Salles’ single family office sees boost in AUM to nearly $11 billion

The family office of the Moreira Salles family, one of Brazil’s wealthiest lines, boosted its assets under management to nearly $11 billion while adding staff.

“BW Gestao de Investimentos Ltda, one of Brazil’s largest single-family offices, added 5.4 billion reais ($1.1 billion) in assets last year as it raked in dividends from its banking and mining businesses,” according to a report by Bloomberg. “The Sao Paulo-based firm also grew its headcount to 78 employees from 69 the year prior.”

“BWGI has been increasing its workforce to adapt to the new markets that it’s begun to operate in,” the Moreira Salles family said in a statement. “It’s worth highlighting the growth in the technology team to support the increase in new resources.”

The family firm, which is currently run by 42-year-old former JPMorgan Chase investment banker Joao Moreira Salles, was founded by his great-grandfather, also named Joao, in 1924. Thanks to a co-controlling stake in Itau Unibanco Holding SA, Latin America’s biggest bank, as well as interests in mining, energy, agriculture and Havaianas flip-flops, the family has a collective net worth of $27.9 billion, according to the Bloomberg Billionaires Index.

As reported by Bloomberg, “The roots of the family’s fortune were laid in 1924, when Joao, who ran a store that sold food, drinks and household goods, founded Casa Bancaria Moreira Salles. The lender financed the expansion of coffee plantations in the 1930s and 1940s.

“His son Walther gradually built the lender into the banking giant known as Unibanco. It was already one of Brazil’s largest financial institutions when it was bought by Itau in 2008. BWGI was founded the same year to manage the family’s money.

“Since the middle of the 20th Century, the family has also controlled CBMM, the world’s biggest miner of a rare-earth metal called niobium that’s used to strengthen steel products, among other uses. Based in Minas Gerais state, the firm also has offices in the US, Europe and Singapore and sells the metal to some 40 countries.

“In 2022, the most recent year for which earnings are available, the closely held company reported 4.5 billion reais of profit on 11 billion reais of sales. The family has a 70% stake in the miner.”

Joe Lewis likely to be spared prison time after pleading guilty to fraud

British billionaire Joe Lewis is likely to be put on probation, rather than given prison time, after pleading guilty to insider trading, according a Bloomberg report.

The 87-year-old businessman and investor, who holds a number of assets mainly through his Tavistock Group investment portfolio, believes that his co-operation with prosecutors are among the factors that weigh in favour of probation over prison, his lawyers said in a court filing.

The former majority owner of ENIC Group and one-time majority owner of Tottenham Hotspur Football Club had previously admitted in a Manhattan federal court to three counts of securities fraud, including conspiracy. According to The National, “US prosecutors had charged him with passing inside corporate information to his private pilots and his girlfriend.

“Under his plea agreement, prosecutors agreed not to oppose a sentence lower than the range suggested under federal sentencing guidelines of 18 to 24 months in prison.

“His lawyers offered another reason to keep him out of prison: As a foreigner, Mr Lewis would not be eligible to serve time in a prison camp with a dormitory setting, but instead would be sent to a higher-security facility with ‘a more dangerous inmate population’.”

Lewis is due to be sentenced on April 4 by US District Judge Jessica Clarke.

Lewis’ Tavistock Group, which has stakes in more than 200 companies, including luxury hotels, resorts and sports venues, helped him and his family to grow a combined net worth of $7.2 billion, according to the Bloomberg Billionaires Index.

Michael Dell unloads shares in Dell Technologies

The family investment office of Michael Dell, founder of the eponymous computer company, has sold a raft of Dell Technologies’ stock totaling more than four million shares, worth about $465 million, according to Bloomberg.

Dell follows a growing number of tech billionaires who have recently sold parts of their companies - including Mark Zuckerberg, Jeff Bezos and Peter Thiel. While he still owns half of the Texas-based company, the largest asset behind his $99.7 billion fortune according to the Bloomberg Billionaires Index, he is believed to have put the shares up for sale as artificial intelligence optimism grows.

“Dell’s shares jumped 32 per cent on March 1 to a record high after the company reported sales and profit that beat analysts' estimates, fueled by demand for technology that can support AI applications,” read the Bloomberg report.

“The stock has gained 52.48 per cent so far this year and is currently trading in the $114 range.”

The 59-year-old billionaire founded Dell Technologies in 1984 while he was a student at the University of Texas.