Is the price of gold too high?

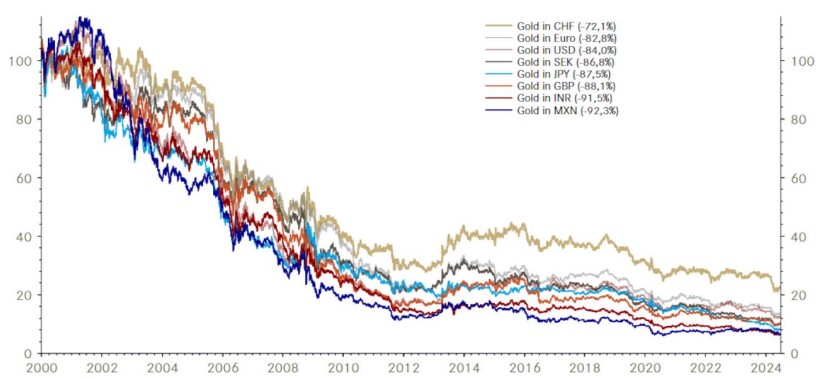

In 2024 the price of gold has surged to unprecedented levels, prompting many investors and analysts to question whether the gold price is too high. What is often lost sight of in this inquiry is a relatively simple, still-revealing relationship between gold and fiat money. Rather than viewing the rising gold price as an isolated, sometimes even speculative phenomenon, it is essential to consider it as a reflection of the deteriorating value of the currencies in which gold is globally measured.

Unmatched store of value

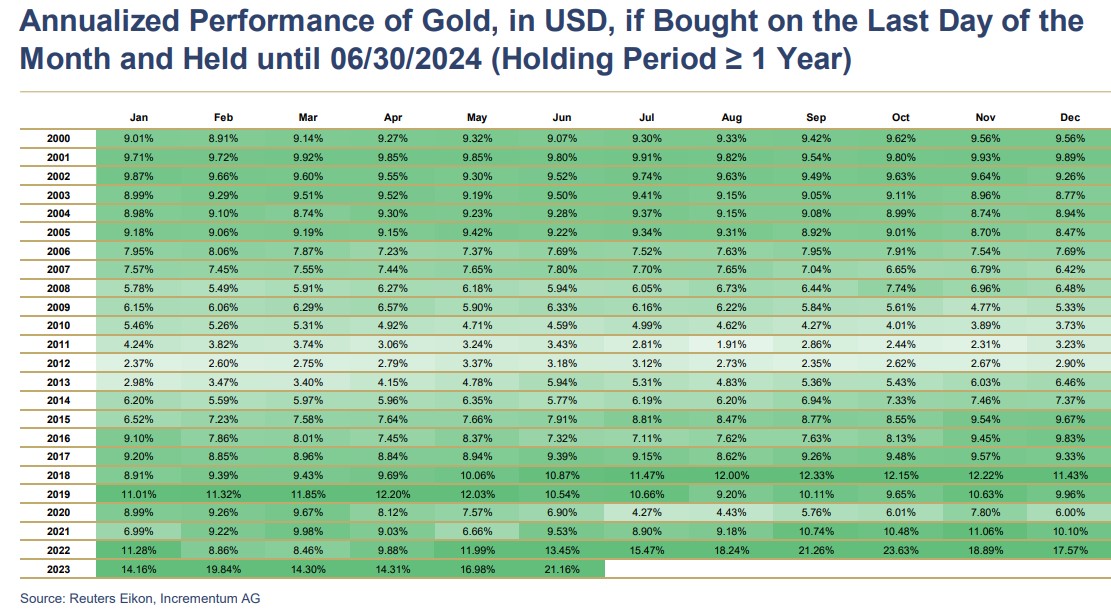

Gold has been a store of value for thousands of years, serving as a hedge against inflation and economic instability. Historically, its price has fluctuated based on various factors, including supply and demand dynamics, geopolitical tensions, and changes in monetary policy. However, one constant remains: gold's real value retains real purchasing power over time in the most reliable way.

The vicious cycle of debt money and why gold will continue to be on top

As fiat currencies – government-issued money not backed by a physical commodity – have become THE prevalent means of exchange over hundreds of years, their value has constantly been subject to erosion due to inflationary pressures and governmental mismanagement. When governments run budget deficits they usually finance this gap by producing new money which can take the form of issuing bonds or other financial instruments. As government debt increases, so does the pressure on central banks to manage that debt through monetary policy.

To service this growing debt, central banks may resort to increasing the monetary base, producing even more money and providing governments with more leeway to use more debt money. This creates a vicious cycle: higher debt leads to increased money supply, which fuels inflation and thereby deteriorates the value of fiat currencies.

The purchasing power of gold is still the same today as it was 20, 50 and even 100 years ago. Technically speaking it is not gold that rises in value. It is the currencies measured in gold that lose value against gold.

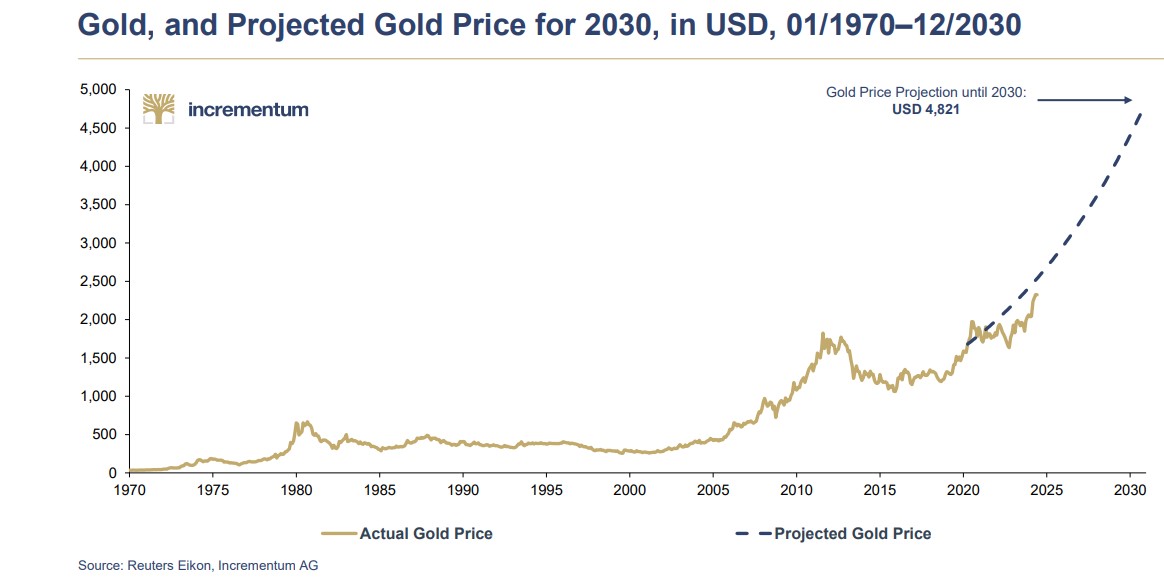

New All-Time-Highs in the gold price simply mirror new All-Time-Lows in the value of the respective currencies.

As long as this vicious cycle is in play, the gold price will never go too high! Gold will simply continue to serve its global wealth protection job with Swiss clockwork precision.

In the next article, we will take a deep look into the role gold plays as a risk management asset and what the exposure in wealthy portfolios looks like, with surprising results.

Your Contact Persons for SOLIT's International Advisory and Individual Solutions Services:

Dr. Oliver Wilhelm, Global Head Advisory and Individual Solutions (based in Germany)

Frank Schulze, Global Head Advisory and Individual Solutions (based in Switzerland)