Report reveals that family office participation in venture continues to grow

The results of an exclusive report by Silicon Valley Bank and Campden Wealth found that family office participation in venture continues to grow despite macro concerns.

Silicon Valley Bank and Campden Wealth’s report, Family Offices Investing in Venture Capital, July 2022, which is released today and can be viewed here, found that families expect to allocate to life sciences and healthcare, enterprise software, consumer internet, fintech and frontier technology as more family offices look to impact investments to bolster their portfolios.

Globally, family offices expect, in the next decade, their highest returns from US-based emerging managers (33%), emerging managers outside the US (28%) and US-based established brand managers (25%).

On average, environmental, social and governance (ESG) and impact investing accounts for 29% in venture portfolios, according to the report which features insights from 139 family offices (77% of which were single family offices) from across 30 countries (49% in North America, 27% in Europe and 25% from the rest of the world).

“We are re-upping with our existing managers,” said a US-based single family office in the report. “We are doing new investments in specific sectors such as cyber and drones. We think the last vintage will be good if it was not called and deployed but the upcoming vintage will be very good. Some GPs are raising sooner than expected because they are afraid that there will be less capital to raise in the future. Funds that would normally be 80% deployed before raising are raising at 50% and leaving more for follow-ons.”

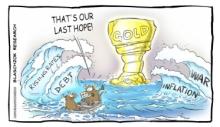

“There is a long list of concerns: High inflation, rising interest rates, geopolitical tensions, declining valuations and where the market is headed, especially in terms of companies that don’t have two years of runway,” says a Europe-based single family office in the report. “But we are optimistic over general tech trends. The speed of innovation and utilisation has accelerated over the last three or four years. There are a lot of opportunities in renewable energy tech, healthcare tech, and B2B SaaS in fintech architecture.

“One factor that shouldn’t be underestimated is that some of the really big funds have raised record funds this year. There is still massive deployment capital out there that needs to be invested in the next few years.”

To read Silicon Valley Bank and Campden Wealth’s report, Family Offices Investing in Venture Capital, July 2022, click here.