The market for private credit secondaries

The growth of the private credit secondaries market has accelerated in recent years, driven by the growth in the primary market, the variety of reasons for investors to sell positions and LPs grappling with liquidity shortfalls.

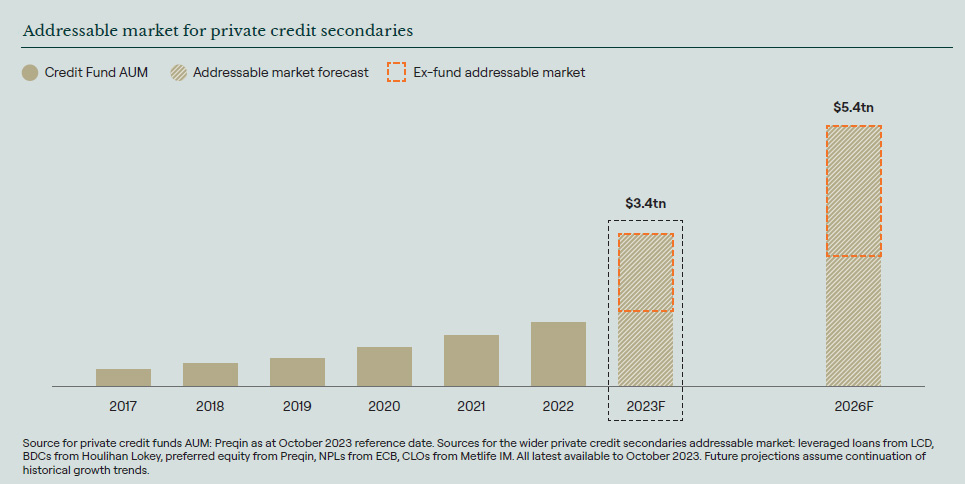

The graph below shows the expanding addressable market for private credit secondaries. Market growth has been driven by assets held in fund structures, which Preqin estimates to be in excess of $2 trillion, but the addressable market also contains assets held outside of funds such as leveraged loans, BDCs, preferred equity, NPLs and CLOs. These ex-fund assets total to approximately $1.3 trillion, resulting in a total addressable market of $3.4 trillion.

Looking forward to 2026, we estimate that the continued growth in the primary private credit market could result in a total addressable market of $5.4 trillion.

Motivations for LPs to sell

A secondaries market for private credit can often seem counterintuitive, given loans are shorter-duration instruments, that more often than not pay back at par. These loans, however, sit in private credit funds, that hold multiple loans, typically between 30-100, and are recycling capital. As a result, the private credit fund investors commit to have a lifespan of approximately eight years.

Since private credit is a long-duration asset class the motivations for investors selling are much the same as in the private equity secondaries market. This diverse seller pool will have a range of requirements, such as quick execution, discretion, legal and tax structuring or portfolio management simplification.

Private credit secondary market growth

The maturing of the primary private credit market has led to an increased supply of secondary opportunities and is reflective of a growth in LPs looking to transact.

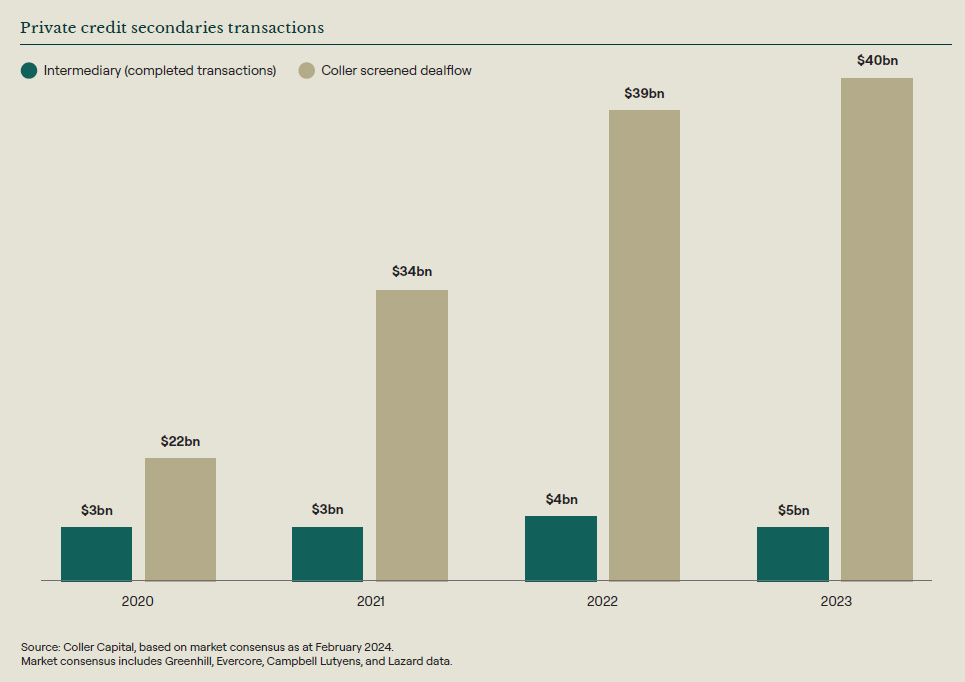

On the buy-side, even today there are relatively few dedicated pools of capital for credit secondaries. Furthermore, much like the early years of the private equity secondaries market, the credit secondaries market experiences relatively low levels of intermediation, with a significant volume of transactions not being captured by broker reports.

The chart below illustrates the consistent rise in intermediated credit secondary volume, which reached $5 billion in 2023.

Moreover, over the same time period Coller has reviewed a sustained volume of deal flow that passes our internal return hurdles, indicative of the broader market for private credit secondaries.

Data correct as at March 2024.