The science of succession – a new view

- Effective succession management requires mastering both general processes and the specific dynamics of the family and key individuals involved.

- Good governance should be implemented proactively to prevent crises, rather than in response to them.

- Families must practice “decentring” by understanding and empathising with each other's perspectives to facilitate successful transitions.

Here are two base assumptions that human sciences – specifically psychology and evolutionary science – tell us about succession in family firms.

The first is that succession is a transition, one of many that affect families in business. Transitions involve known processes that need to be handled following well-known principles. The second is that every individual, and every family, is unique, as are the challenges they face and the solutions that will work for them. The management of succession is therefore a bespoke process.

To manage succession, we have to master both the general – what we know about the best way to handle the process; and the particular – the specific identities of key individuals, the family dynamic and the conditions of their time, place and situation.

Transition Cycles

Our lives are punctuated by transitions. Some of them are willed and chosen, like getting married or taking a job. Others are involuntary, like ageing, bereavement and the sundry crises that may befall us at any time.

We are in a constant state of transition in multiple domains simultaneously – such as work, relationships and status. A transitions perspective was brought to the family business field by John Davis and Renato Tagiuro in their classic Three Circles Model. This observes that firms must face the prospect of changes in family structure (nuclear through to complex tribe), ownership (controlling owner through to dispersed network), and business development (start-up through to mature business).

It is dangerous to assume these transitions follow any set sequence, but there are common critical inflexion points. In business, it is the shift from entrepreneurial fluidity to the more structured necessities of the managed firm. As any family business advisor will tell you, good governance systems are often brought in too little and too late, after a crisis rather than in advance to forestall one.

Family and ownership transitions are at their most challenging in the early stages – from G1 to G2 or G2/3, where seniors – often feeling at the peak of their powers – must consider how to give way to a new young next generation ready to participate. In the shrinking families of the modern era – especially in Southeast Asia and some Western economies where the birthrate has plummeted, there is the very real prospect of a next generation unwilling or unable to place their future in the firm.

Let’s see how a transitions perspective can help us. Here are some key points.

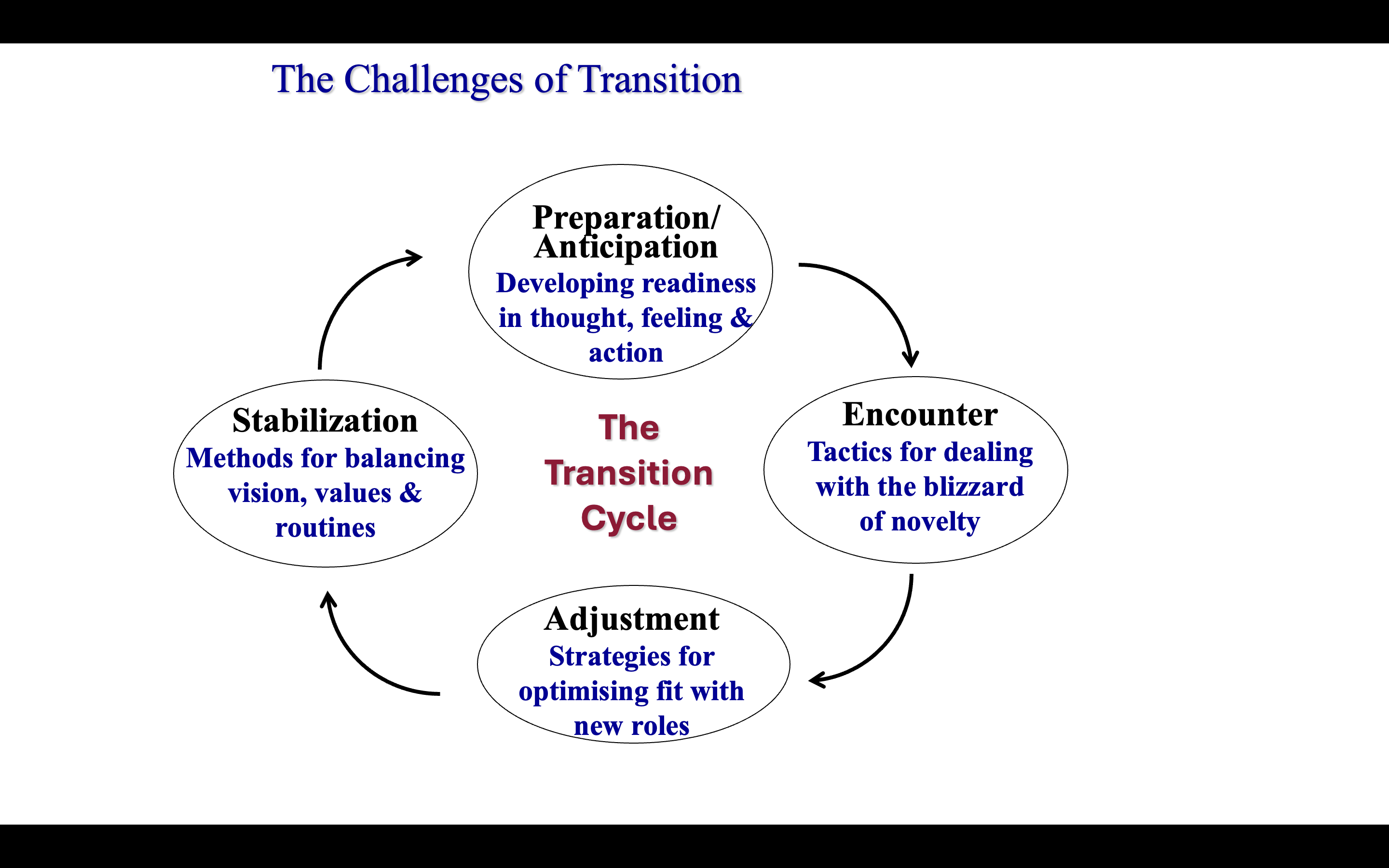

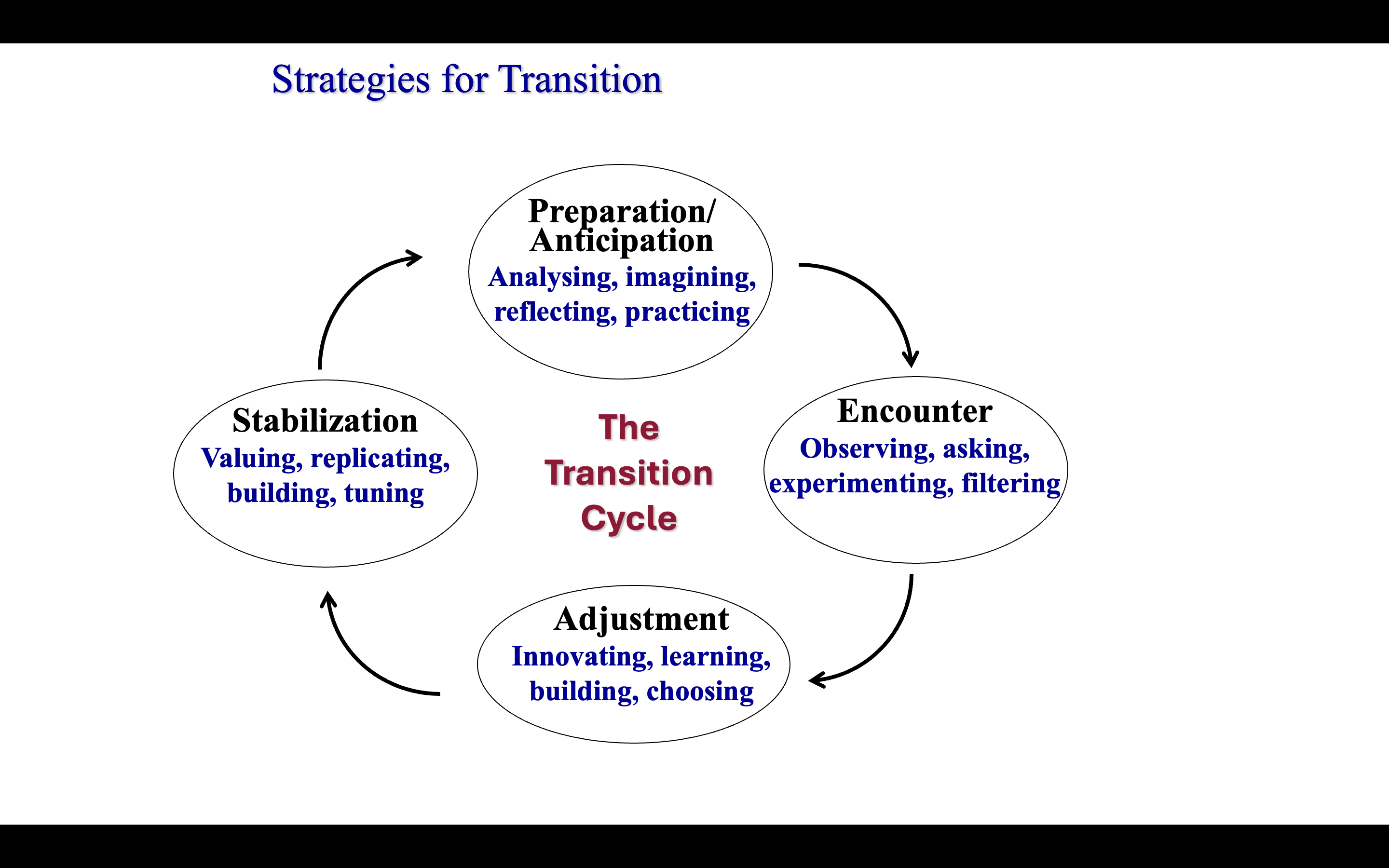

- Transitions are a cyclical process. You need different goals, tactics, and processes at each of the four stages: Preparation, Encounter, Adjustment, and Stabilisation. [See Figures 1 & 2 below].

- The bigger and more unexpected the transition, the more radical the consequences. Consider how the pandemic produced permanent (often beneficial) changes to many people’s ways of living and working.

- The toughest challenge for anyone in transition is letting go. This is especially tough for founders, who have invested the best of themselves and their lives. Yet, it is necessary to embrace the new, as we shall discuss later.

- Emotions play a key role at every stage, along with narratives about what is happening and why. These are often misleading. Feelings dangerously lead thoughts at such times, for it is often hard to imagine how different things may look around the next bend.

- Transitions are everyone’s business. Even if you are not at the epicentre, you have a key role to play in sharing understanding and supporting best practice in managing them.

The Uniqueness Imperative

My own research and practice in family business has placed UI – Unique Individuality – at centre stage[i]. Standard models are great at giving you a heads-up about key principles and likely hazards, but the only effective approach is bespoke. Every one of us is unique in our attributes, experience and perceptions and every family is unique, not just because of its members but also due to their configuration – size, structure, genders, age spacing, and their culture – their accustomed ways of dealing with each other and solving problems.

I take a two-pronged approach in my work. One is through the use of psychometrics, especially the power of personality profiling. The other is a biographical approach, understanding the history of members and the family itself through their lifetime transitions and what came out of them. This can be made sense of in my 4-D framework, developed to help generations of executives make sense of their personal journeys, both within and outside the family context. In each case below you can substitute the word “family” for “you”, to represent the UI of the family:

- Destiny: This does not mean foretold, but rather your givens. It is the hand dealt you in life in terms of your psychological profile, origins, circumstances and culture.

- Drama: The events that befell you have unexpected consequences. This is true of pretty much any life event, choice, or transition. What matters is how you have dealt with them.

- Development: You live and learn, not just through structured media, but informally through experience. These are the lessons, wisdom and insights, and sometimes fears, that you have acquired on your journey so far.

- Deliberation: These are the times – rarer than you might suppose – when you paused, reflected and made an active decision about the direction you were headed.

Family Succession Roadmap

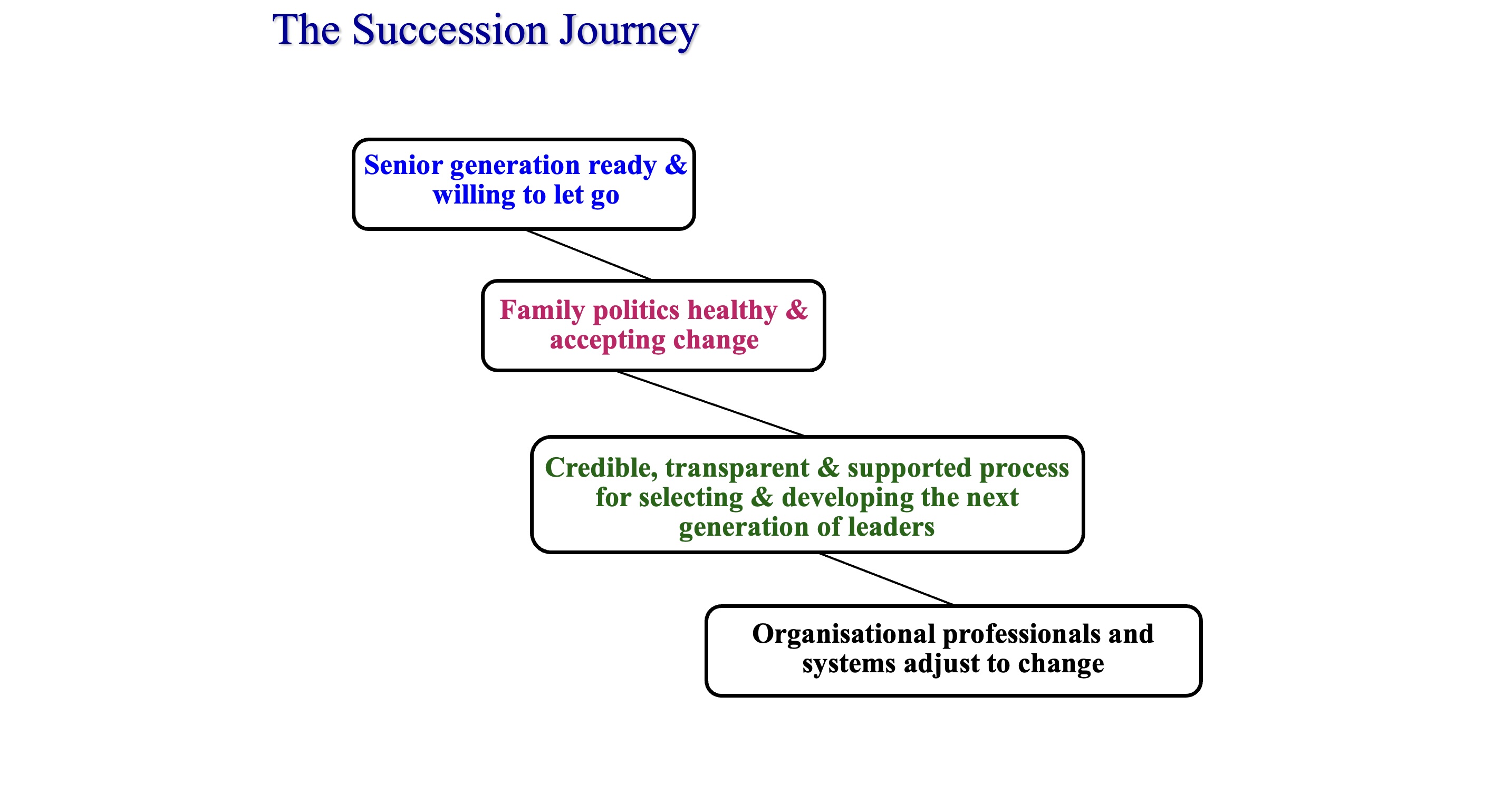

Figure 3 summarises the succession journey.

Starting at the top of the model is family ready for change? Especially important is who is having to let go of what, and in exchange for what? Families need what I call “decentring” practices – seeing the world through the eyes of the other – to empathically help people find new fulfilment in new roles after letting go.

Second, the family dynamic needs attention, taking the UI – Unique Individuality – perspective – along with 4D thinking, to help families get to deeper understandings of each other’s perspectives. This is achieved through a structured process of sharing profiles and self-narratives.

Third, the process of transition needs to be managed as a developmental journey, where everyone needs to acquire new skills, perspectives and practices. It is essential that this does NOT seek to replicate any previous models of leadership. The new successors need their own bespoke model, fitting them as unique individuals and specific challenges facing the firm now and over the horizon.

Fourth, the machinery of enterprise has to evolve continually with the firm and its people. This means that full engagement and partnership with non-family professionals and other non-family stakeholders.

Wrapped around this are four prerequisites

- Good governance – ways of making decisions that embrace diversity of people and interests, to find common purpose for the greater good.

- Intelligent leadership – methods and approaches that are cognisant of the evolving leadership situation being faced, and the capabilities and UI of key stakeholders.

- Healthy culture – norms of respect, listening, situational awareness, exchange and emotional support, plus times of coming together to celebrate, create and plan.

- Professional support – groupthink is a constant danger, especially in highly cohesive families. To challenge what we may take for granted, seek out the diverse perspectives of non-executives, non-family and professionals inside and outside the firm.

The worst that can happen is that the family concludes that the risks of persisting where none of these conditions can be met is that it will be a race to see which destroys the other first, the family or the business. This is where families have to calculate the limits to their ability to adapt, entailing a realistic and flexible view of the participation of the family and its members in the business and ownership. Some might best conclude that this is the time to step away and be happy living separate lives. Being a business family doesn’t have to be a failing endurance test.

Nigel Nicholson is Emeritus Professor of Organisational Behaviour at London Business School. His research interests include the psychology of family business, biography and leadership, financial decision-making and people skills in management. He has published over 20 books and 200 articles in these fields, as well as on topics such as innovation, organisational change and executive career development. He is currently working on a new book on Uniqueness. See www.nigelnicholson.com for further details.