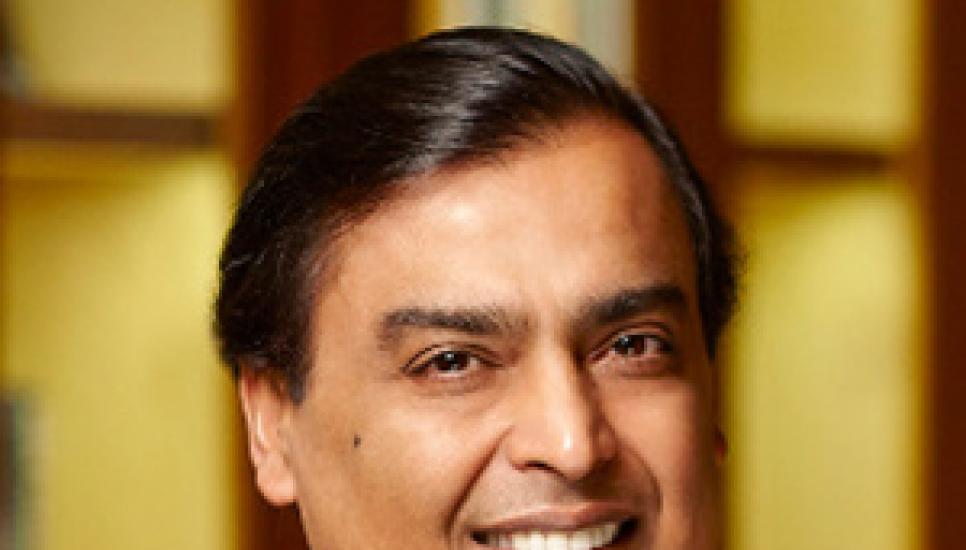

FB Roundup: Mukesh Ambani, Joe Tsai, Patrick Drahi

Mukesh Ambani makes £5 billion bid to buy Boots

Indian billionaire Mukesh Ambani has teamed up with American private equity company Apollo Global Management to make a £5 billion tender for the UK pharmacy retail giant Boots.

Ambani, who is the richest person in Asia and the seventh richest in the world (according to Forbes), has been working on a potential buyout for the high street chain since April through his Reliance Industries firm and is now placed for a formal takeover.

Ambani, who was one of the long-listed bidders to purchase Chelsea football club, is said by Bloomberg to be keen to build a foothold outside Asia. The purchase of Boots comes about after its owner Walgreen Boots Alliance (WBA) announced a review of the business and potential sale.

“I remain absolutely confident that if Reliance buys Boots we would have the emergence of a brand again - and it would be a world-leading brand,” said business consultant Uday Dholakia to ITV News Central of the chain which has more than 2,200 stores across the UK. “I can see [Boots] in Africa, in the Indian sub-continent, Malaysia and Singapore.”

“Speculation has been rife about where the pharmacy business might end up since Walgreens put it up for sale earlier this year and at one point it looked like it might find its way back into public hands,” said AJ Bell financial analyst Danni Hewson. “There are huge opportunities for a new owner to revolutionise the business, revitalise the ageing store portfolio and create wellness hubs or mix up the retail offer.”

Billionaire Joe Tsai invests millions in Just Women's Sports

The family office of billionaire Alibaba co-founder Joe Tsai is among a host of angel investors in a media platform dedicated exclusively to women’s sports.

Just Women’s Sports has raised $6 million from new and returning investors – including tennis icon Billie Jean King; Michele Kang, the owner of women’s soccer club Washington Spirit; and the family office of financier and New Jersey Devils hockey team owner David Blitzer – in a funding round led by Blue Pool Capital, the family office of Brooklyn Nets basketball team owner Joe Tsai.

“The business case for women’s sports has never been clearer, and Just Women’s Sports is positioned to be the leading media platform in the space,” said Tsai. “We’re thrilled to partner with them as they enter this next phase of growth.”

“Just Women’s Sports is building on the foundation of earlier pioneers by creating a media platform that celebrates and elevates the incredible athletes and stories in women’s sports,” said Billie Jean King. “[The] team have the vision and talent necessary to usher in a new era in sports media.”

“Two years ago, we saw a massive opportunity to tap into an audience that was extremely underserved by traditional media,” said Just Women’s Sports founder and chief executive officer Haley Rosen. “We knew the on-field product was great, and that women’s sports just needed better coverage and smarter marketing to truly break into the mainstream. This latest round of funding gives us the resources to cement our status as the leading platform in the space.”

Just Women’s Sports, which previously raised $3.5 million in May 2021, has already worked with a host of big brands, including Nike, Puma, Under Armour, Heineken and Cisco.

Patrick Drahi’s proposed takeover of BT expected to be blocked by UK government

Patrick Drahi’s proposed takeover of BT expected to be blocked by UK government

French–Israeli billionaire Patrick Drahi’s proposed takeover of telecoms giant BT is expected to be blocked by British business minister Kwasi Kwarteng with a cap on any further stake-building under new national security laws.

Kwarteng’s Department for Business, Energy and Industrial Strategy (BEIS) previously said that Drahi's 18 per cent stake in BT would be reviewed under new legal powers intended to give ministers more control over critical infrastructure.

In December 2021, Drahi's European telecoms firm Altice increased its BT stake from 12.1 per cent to 18 per cent, making him the single biggest shareholder. The government’s involvement is intended to block Drahi, who has an estimated net worth of £9 billion (according to Forbes), from further increasing his stake and influencing the internet and telecoms provider’s board.

The mediation follows on from a similar intervention in 2020 when Chinese telecoms giant Huawei was confirmed to be banned from the UK's 5G networks by the end of 2027.

Drahi is said to have borrowed against the London headquarters of his Sotheby's auction business to help fund his stake-building, following Altice’s cancelled plans to sell its Portuguese base and a collapse in the valuation of Altice USA.