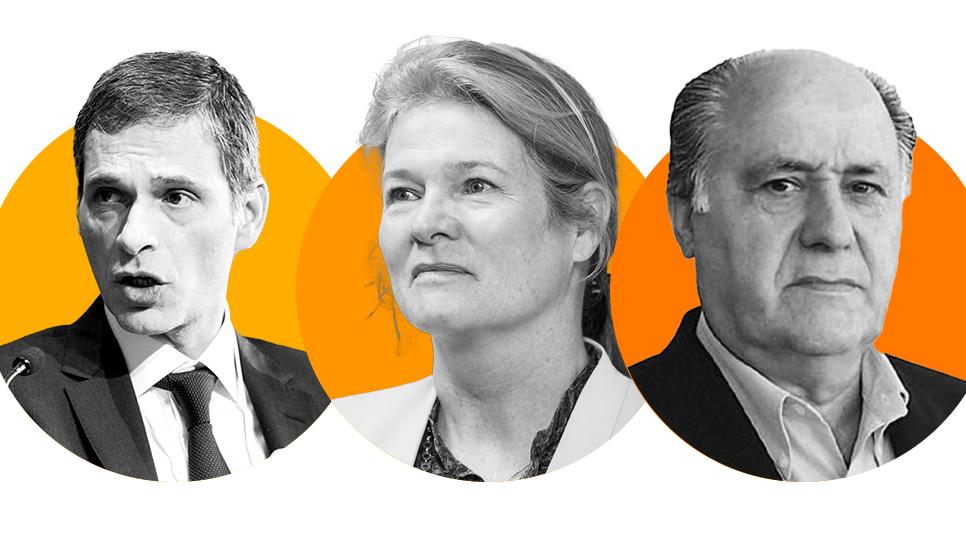

FB Roundup: Rodolphe Saadé, Charlene de Carvalho-Heineken, Amancio Ortega

Rodolphe Saadé expands media empire with new Sunday newspaper launch

Rodolphe Saadé, the chairman of container shipping firm CMA CGM, which was founded by his father Jacques Saadé in 1978, is building on his French media empire with plans to start a new newspaper.

Following on from French conservative media tycoon Vincent Bolloré’s controversial purchase of prominent periodical, the Journal du Dimanche (JDD), Saadé is planning to launch his own Sunday weekly having previously purchased online business daily La Tribune.

“We’re building our editorial team,” said La Tribune president Jean-Christophe Tortora in an interview with France Info radio.

Tortora also confirmed reports that he is hiring journalists from JDD, including incoming editor Bruno Jeudy, following a prolonged staff strike in protest at Bolloré’s appointment of ‘far-right commentator’ Geoffroy Lejeune as editor.

As reported by The National, Tortora said the new paper will be “well-rounded”, carrying articles spanning business, culture and literature and will “respect editorial independence”.

Saadé’s, whose family’s net worth is $23 billion (according to the Bloomberg Billionaire Index), was made chairman of CMA CGM’s board in 2017. He also controls three newspapers in France – La Provence, La Tribune and Corse Matin – as well as having stakes in TV channel M6 and media web site Brut. He has also been touted to take over news channel BFMTV.

Heineken sells Russian business at a loss of £256 million

The fourth-generation Dutch international brewer Heineken has sold its Russian business interests for just 86 pence and faces a total loss of £256 million in the wake of increased Government sanctions.

The brewing giant, which also makes Amstel and Birra Moretti beers, previously announced that it was quitting Russia in March 2022 in the wake of the war in Ukraine, saying at the time that its business there was “no longer sustainable nor viable in the current environment”. However, as reported by Sky News, Heineken “executives admitted the process ‘took much longer than we had hoped’ and said looking after its local employees was a priority.”

“Recent developments demonstrate the significant challenges faced by large manufacturing companies in exiting Russia,” said Heineken’s chief executive Dolf van den Brink following the announcement that the new Russian owner, Arnest, has pledged to guarantee the employment of 1,800 local staff for the next three years.

Heineken-branded beer ceased being sold in Russia last year, however Amstel is still on sale and will be phased out in the next six months. According to Sky, “despite the multi-million-pound loss, Heineken believes the cut-price transaction will have a negligible impact on its full-year outlook”.

Billionaire businesswoman Charlene de Carvalho-Heineken inherited her 23% stake in Heineken from her late father, former chief executive officer Freddy Heineken. Her husband, British financier and former Olympic skier and actor Michel de Carvalho, sits on Heineken’s board.

Amancio Ortega adds to US property portfolio with $232 million Chicago apartment building

Pontegadea, the family investment vehicle of Spanish billionaire Amancio Ortega, the founder of fashion giant Inditex, has reported a €2.8 billion boost in the market value of its real estate assets to €18.1 billion – and it’s set to rise further with the recent purchase of a luxury apartment building in Chicago for $232 million.

The founder of the global fashion retailer which counts Zara, Pull&Bear, Massimo Dutti, Bershka, and others amongst its brands, Ortega has acquired the 45-storey 727 West Madison, adding to a growing portfolio of US properties, including Meta Platform’s headquarters in Seattle and Manhattan’s Haughwout Building.

According to Bloomberg, the Chicago tower contains “492 high-end apartments, with rents from about $2,200 a month for a studio to up to $6,000 for a three-bedroom unit”.

Ortega, who is Spain’s wealthiest person with a $75 billion fortune (according to Forbes), spent up to $1 billion in 2022, buying up US warehouses in a diversification strategy going beyond his traditional retail focus. He also has interests in infrastructure with a stake in an undersea telecoms cable company, electricity and gas networks in Spain and Portugal, and a renewable energy project with global power firm Repsol.