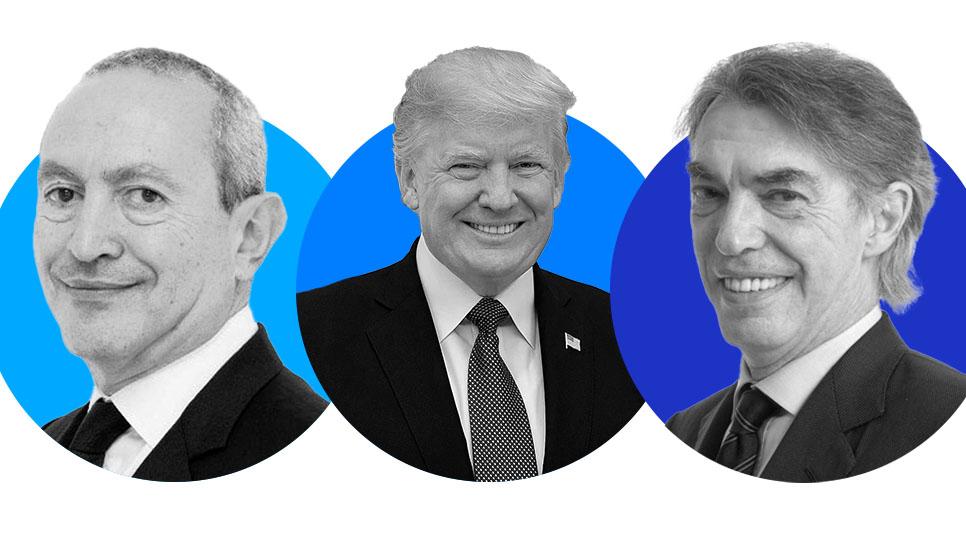

FB Roundup: Nassef Sawiris, Donald Trump, Massimo Moratti

Nassef Sawiris considers breaking up his business empire

Egyptian communications and gold billionaire Naguib Sawiris is reportedly considering an overhaul of his chemicals and fertiliser conglomerate “that could include additional divestitures and the fragmentation of his primary holding”, according to a report by The Financial Times.

Egypt’s wealthiest man has already sold more than $7 billion USD in assets over the past two months and now the 63-year-old billionaire has “expressed his interest in a complete overhaul of the business that forms the cornerstone of his fortune, Dutch-listed chemicals group OCI”, says The FT.

“We’re evaluating what we want to do, not just with the money [from the asset sales] but as a team,” said Sawiris. “And maybe OCI stays with a piece or two pieces and it becomes a cash cow and becomes a machine for further investment. We’re quite open-minded.

“It doesn’t have to be fertiliser, doesn’t have to be chemicals. If all of OCI is sold, the core team… know that we are serial entrepreneurs and we’re going to do something.”

The son of Orascom Group founder Onsi Sawiris and eldest of three brothers (his younger siblings Nassef and Samih are also billionaire businessmen), Sawiris’ remarks come in the wake of heightened deal activity at OCI, spurred by pressure from US activist investor Jeff Ubben, as well as within Sawiris' NNS Group family office.

Sawiris - whose net worth is estimated at $8 billion USD (according to Forbes) with a portfolio that includes ownership of Aston Villa and stakes in sportswear brand Adidas and high street café chain Joe & The Juice - holds an almost 40 per cent stake in OCI, while his family hold a further 14 per cent.

“We always say that we are builders, not holders,” said Sawiris. “We build assets. But if this asset is worth more to another party than it’s worth in the context of OCI or the public company or of myself, then that is the more deserving owner.”

Donald Trump’s niece blames ex-US president for ending their family’s wealth legacy

Mary Trump, the outspoken niece and vocal critic of former United States president Donald Trump, has blamed the billionaire businessman for effectively ending their family’s wealth legacy after he was ordered by a New York judge to pay more than $350 million USD in damages and temporarily limited his ability to do business in New York.

Judge Arthur Engoron ordered the former president and the Trump Organization (including his sons, Donald Jr and Eric) to pay the huge fine in damages, and barred Trump “from serving as an officer or director of any New York corporation or other legal entity in New York for a period of three years,” including his namesake company.

Following the judgement, which was laid down in a civil business fraud trial, Mary Trump (who is the daughter of Linda Clapp and Fred Trump Jr, the son of real-estate developer Fred Trump), wrote on social media platform X: “Judge Engoron has just ordered Donald to pay a staggering $350 million+ in penalties in his fraud case and he rules that Donald can't do real estate business in the state for three years.

“It’s the end of my grandfather’s legacy. Today is an emotional day, but one thing is certain: the Engoron decision is absolutely devastating for Donald.

“It has taken over half a century but Donald's ability to commit fraud with impunity has come to an end - at least in New York - and trust me, that matters to him."

As reported by NBC News, ‘New York Attorney General Letitia James, whose office brought the case, said that with pre-judgment interest, the judgment totals over $450 million, an amount “which will continue to increase every single day” until the judgment is paid.’

“Donald Trump is finally facing accountability for his lying, cheating, and staggering fraud. Because no matter how big, rich, or powerful you think you are, no one is above the law,” said James in a statement, calling the ruling “a tremendous victory for this state, this nation, and for everyone who believes that we all must play by the same rules - even former presidents.”

During the trial, Trump reportedly attempted to blame exaggerated financial statements ‘that were at the heart of New York Attorney General Letitia James’ fraud case on the accountants who compiled them.’

Trump's lawyer, Alina Habba, meanwhile, said in a statement: “Given the grave stakes, we trust that the [appeals court] Appellate Division will overturn this egregious verdict and end this relentless persecution against my clients.

“Let me make one thing perfectly clear: this is not just about Donald Trump - if this decision stands, it will serve as a signal to every single American that New York is no longer open for business.”

Massimo Moratti’s family to sell key stake in refining firm

The family of Italian billionaire petroleum businessman Massimo Moratti have agreed to sell a controlling stake in refiner Saras SpA to commodities trading giant Vitol Group.

The deal, which is valued at about $1.9 billion USD, sees the privately-owned Vitol adding to their huge profits over the past few years, following a boost in oil, gas and power markets in the wake of the Covid-19 pandemic and Russia’s invasion of Ukraine.

According to Bloomberg, “the Moratti family reached a deal to sell about 35% of Saras at €1.75/share, according to a statement from the family. Angelo Moratti, one of Massimo Moratti’s nephews, may also sell his remaining 5% which is linked to a collar derivate contract.”

Following the deal, Vitol, the world’s largest independent oil trader, is then expected to launch a takeover bid for the remaining Saras shares.

“Saras’ business is highly complementary to Vitol’s core operations," said Vitol CEO Russel Hardy to Bloomberg, noting that the refinery was “a key European energy asset."

The Moratti family has a 40% holding in Saras, giving them control of the firm. Massimo Moratti, the chairman and chief executive and a former owner of Inter Milan football club, holds 20%. His nephews Gabriele Moratti and Angelo Moratti each own 10% via holding companies.

“62 years after my father founded it, together with my nephews, I believe that the best assurance for the future success of the Sarroch refinery is the aggregation with a leading player in the global energy sector, such as Vitol,” said Massimo Moratti in the statement.

The Saras Group was founded in 1962 by industrialist Angelo Moratti (of whom Massimo Moratti is his fourth son). The main production site of the Saras Group is the Sarroch refinery located on the island of Sardinia, one of Europe’s only six supersites, with a capacity of 300,000 barrels per day, representing 15% of refining capacity in Italy.

In recent years, the Saras Group has entered into the production of electricity and is expanding its production of alternative energy sources, particularly in the field of wind energy, through its subsidiaries Sarlux and Sardeolica, the latter of which is controlled indirectly through the company Eolici Ulassai.