Tax transparency pays off

There is limited data to inform the public tax debate on the contribution of family businesses in the UK. Corporation tax is the most visible when it comes to financial reporting and regulation, but many other business taxes are paid. The UK’s Family Business Research Foundation (FBRF) and PwC collaborated on a study to systematically collect such data for the first time, with the purpose of understanding the tax contribution from UK family firms. This is part of an ongoing programme of research by the FBRF to assess the contribution that family firms make to the UK economy and society.

The collection and reporting of data on the full range of taxes that a firm pays and contributes to public finances – what PwC calls the Total Tax Contribution (TTC) – can be thought of as part of a family firm’s sustainability or ESG narrative and can potentially help enhance brand value.

Many family-owned firms adopt a long-term orientation in their strategic decision-making. A common priority for such firms is to create a legacy for future generations of the business family. Furthermore, many business families and the firms they run are deeply embedded in local communities and often make a valuable contribution to the communities in which they operate.

Robust data

Collecting robust data on family firms’ TTC is one way of demonstrating the wider contribution they make to society. During 2022-23, PwC and the Family Business Research Foundation undertook a survey of family firms to collect TTC data. Data was collected from 44 family firms on all the different taxes that the firms pay and administer, including corporation tax, employment taxes, VAT and other taxes; all the taxes borne by these firms; and the taxes they administer and collect on behalf of the Government.

Using this data, it was estimated that the family-business sector contributed £225 billion to the UK Exchequer in 2021, representing 27% of all UK tax receipts. Out of this £225 billion, £74 billion was contributed in taxes borne, which are a direct cost to a company, and £151 billion in taxes collected, such as income tax and employee National Insurance Contributions (NICs). On average, the amount paid in employment taxes was £11,468 per employee.

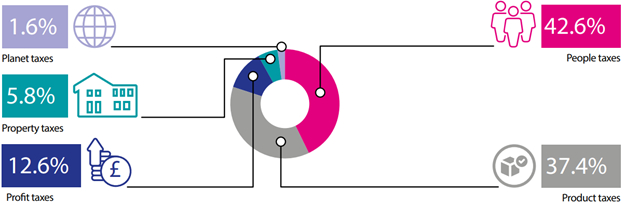

The 44 participating firms provided data for, on average, 10 taxes, 6.7 taxes borne, and 3.3 taxes collected. Taxes paid by study participants covered five tax bases: people, product, profit, property and planet taxes.

The evidence from this study shows that family businesses are investing in their employees and their communities. For every employee in the study, an average of £11,468 was generated in employment taxes, and many family firms also provided training and mentoring to apprentices. The largest element of value distributed by family firms in the study was to employees in wages (41%), followed by amounts generated in taxes (34%).

Family firms can use TTC in a number of ways. Internally can be used to engage with management and employees to raise awareness of the taxes their company pays and collects. It can be used in the management of taxes, to assess whether governance processes are sufficient for the broad range of taxes paid by the company. Information about a company’s TTC can also be a topic for discussion with family firms’ sustainability teams, as part of its ESG performance and social impact.

But it can be used externally too. First, to engage with tax authorities on tax policy matters or to highlight the taxes paid by the firm. Then, listed family firms, can use TTC with investors and fund managers, given their increasing interest in ESG. Finally, TTC data can be used in family business forums, to raise awareness of the contribution of family firms in taxes as part of the firms’ social and economic impact narrative.

Transparency and communication

Our TTC study of family firms highlights the importance of tax transparency and communication for family businesses, especially in the context of increasing public scrutiny and stakeholder expectations. It shows how family businesses can use TTC data to engage with tax authorities, policymakers, investors, customers, employees and the wider public to demonstrate their economic and social value. Finally, the study provides insights and recommendations for policymakers and tax administrators on how to better support and recognise the family business sector, and to model the impact of any tax changes on this vital part of the economy.

Martin Kemp, Family Business Research Foundation and Andrew Wiggins, PwC