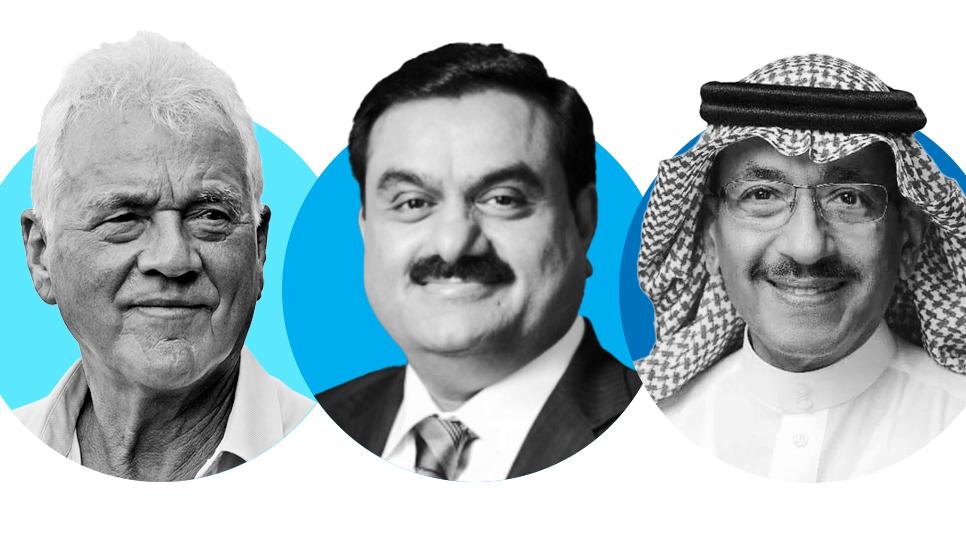

FB Roundup Fakeeh family, Gautam Adani, Frank Stronach

Fakeeh family swells fortune after initial public offering

Saudi Arabia may be better known for oil billionaires, but healthcare can now be added to the list.

The family of Soliman Fakeeh has increased its fortune to $2.9 billion following the overwhelming success of the initial public offering (IPO) of Fakeeh Care Group on 5 June 2024 on the Saudi Exchange.

Founded in 1978 in Jeddah, the group now has 835 beds across four hospitals and five medical centres. It intends to expand to seven hospitals with 1,675 beds and nine medical centres by 2028.

In the country’s biggest IPO of the year so far, handled by HSBC along with ANB Capital and EFG Hermes and advised by Moelis & Company, the family sold a 21.5% share in the group. The IPO was 119 times oversubscribed.

The family retains a 78.5% stake in the group.

“Today marks a historic milestone for Fakeeh Care Group as we commence trading on the Saudi Exchange. Since 1978, we have been dedicated to providing high-quality, integrated healthcare that is accessible, personalized, and compassionate. Our IPO represents a significant step forward in our journey, allowing us to further invest in our mission of delivering patient-centric care and expanding our footprint across the Kingdom,” said Mazen Soliman Fakeeh, President of Fakeeh Care Group. He is the largest shareholder in the group along with his brother Ammar Fakeeh. Their sister Manal has a smaller stake. Soliman Fakeeh himself passed away in 2014.

In February, Dr Soliman Fakeeh Hospital in Jeddah was recognized as the best private hospital in Saudi Arabia for the third year in a row by Newsweek magazine.

Gautam Adani retakes spot as Asia’s richest man

Last week Gautam Adani reclaimed his spot as Asia’s richest man, according to the Bloomberg Billionaires Index, with a net worth of $111 billion.

Adani is chairman of the $32 billion Adani Group conglomerate which has diverse interests such as ports, airports, power generation and transmission, coal mining and green energy.

He has successfully developed Mundra Port which is now India’s largest commercial port, and is developing Adani Green's Khavda power plant which is not only the world's largest, it is also said to be five times the size of Paris. The renewable energy cluster at Khavda uses solar energy in the morning and wind power in the evening.

“Being an entrepreneur is my dream job as it tests one’s tenacity. I could never take orders from anyone,” he has said.

The news is welcome to Adani after a challenging 12 months. A report in January last year by US short-seller Hindenburg Research caused a more than $150 billion selloff in the conglomerate's stocks despite the company's denials of any wrongdoing. It took several months, but the Securities and Exchange Board of India (SEBI) effectively exonerated the group later in the year which stabilised its outlook.

Adani’s wife, Priti Adani, has been chair of the Adani Foundation since it was founded in 1996.

Auto parts billionaire arrested in Canada

Frank Stronach, the founder and former chief executive of Canadian auto parts company Magna International has been arrested on multiple charges of sexual assault and rape spanning from the 1980s to as recently as 2023.

The Austrian-born, 91-year-old entrepreneur was charged on five counts last week according to police in Peel, a regional municipality in the Greater Toronto Area.

Stronach has been released on conditions and will appear at the Ontario Court of Justice in Brampton at a later date. Police are appealing to members of the public to come forward if they have any relevant information.

Stronach has denied all accusations.

He founded Magna in his garage in Toronto in 1957 which is now one of the largest companies in Canada. Magna’s first contract was for metal sun visor brackets with General Motors in 1959. The firm now supplies parts and components to auto manufacturers as diverse as General Motors and Ford as well as BMW, Mercedes, Volkswagen, Toyota, Tesla, and Tata Motors.

Stronach also founded The Stronach Group, better known as 1/ST, which is known for thoroughbred horse racing and sports gambling. Its chair, president and chief executive is his daughter Belinda Stronach.

Stronach divested himself of all equity in Magna by 2013 and placed his assets in trusts for his children.