The long-term investment value of the Chinese art market

- The Chinese art market has boomed in the 21st century and is now the second largest globally.

- Continued collector and investor interest is expected as China’s economy grows. Chinese art seen as a long-term investment with inflation-hedging potential.

- In the Spring of this year, ink paintings have outperformed oil paintings and modern art has outperformed contemporary art.

The Chinese art market has demonstrated a lot of vibrancy as we entered the 21st century amid a boom in the Chinese economy. China now accounts for 20% of the global art market, second only to the US, according to the 2021 Art Basel and UBS Global Art Market Report. Data released by Statista shows that art transactions worldwide rose in value to $67.8 billion, among which works by Chinese artists living in Greater China and overseas (referred to collectively as Chinese artists) have been noteworthy. The MM Chinese Art Indices came into being in response to this trend: to track market developments, rationally value artworks, and support the healthy growth of the Chinese art market.

On 5 September last year, I launched the MM Chinese Art Indices, a biannual reference guide that determines the changing popularity of the Chinese art market by measuring repeat auction sales, in collaboration with Michael Moses, a retired professor at New York University, and Jiang Guolin, a retired researcher at the Shanghai Academy of Social Sciences.

The MM Chinese Art Indices examine prices, sentiment and artists’ liquidity. The aim is to offer a scientific, systematic, and comparable system that can aid decision-making when investing in Chinese art, still quite a black box to many in the art investment world.

The long-term study is based on the auction records of Sotheby’s, Christie’s and Phillips in Beijing, Shanghai, Singapore, Paris, London and New York. The data comes from the official websites of these three major auction houses and artprice.com, an art price database, of artworks by over 400 Chinese artists which have been repeatedly put up for auction between 1980 to 2024. The latest 2024 Spring Auction Index shows that the Chinese art market is still in a period of consolidation, with a somewhat slowing downward trend.

A period of adjustment

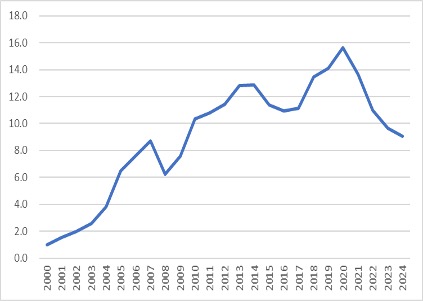

We can consider the price index in three stages: 2000-2007, 2008-2013, and 2014-2024. In the first stage – the post-WTO accession period between 2000 and 2007 – China’s economy boomed as its Internet revolution gathered momentum and with it the Chinese art market. The index rose from 1 at the beginning of 2000 to 9.7 at the end of 2007, an increase of 8.7 times in eight years, indicating a veritable bull market.

In the second stage – the global financial crisis era – the market plummeted 26.5% in 2008, but it then resumed its rise to 15 by the end of 2013 with a CAGR of 9%.

In the third stage, the pandemic and interest rate hikes in the US put a massive dampener on the market, slowing compound annual growth to -2%.

We note that the Chinese art market has entered a period of adjustment since reaching its peak in 2020, and will take some time to recover, in light of the impact of the pandemic and a Chinese economy in transition.

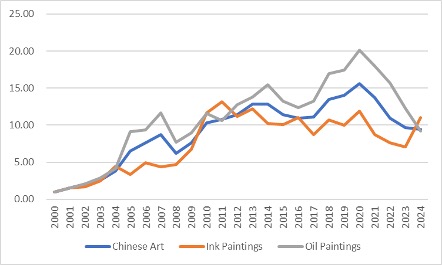

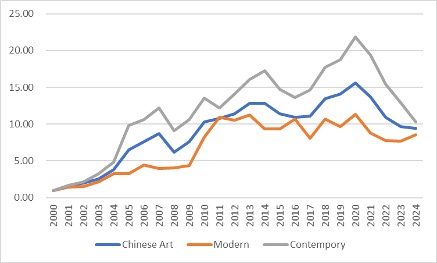

To capture a unique segment of the Chinese art market, the MM Chinese Art Indices include separate indices for ink paintings and oil paintings. To study the relationship between the era in which the artist lives and the art market, the MM Chinese Art Indices also include modern and contemporary indices, covering artists born prior to 1911, and since then.

In Spring 2024, the ink painting index rebounded strongly, breaking the downward trend since 2012, returning to its 2016 level and outperforming the oil painting index. By the same token, the modern index also did better than the contemporary index in spring 2024 (Figures 2 & Figure 3).

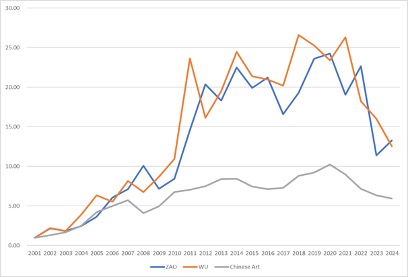

Take the contemporary Chinese artist Wu Guanzhong.

Between 2001 and 2024, he sold more than 700 paintings for a total of $440 million at the three major auction houses. The Jiangsu-born painter’s long-term price trend is quite strong, with a compound growth rate of 11.6% from 2001 to the Spring of 2024, only slightly lower than that of his fellow China Academy of Art alumnus Zao Wou-Ki’s 11.9%.

Wu Guanzhong’s age value curve peaked at about 51 years old, indicating that collectors are willing to pay the highest premium for works created around that age.

The liquidity of artists’ works

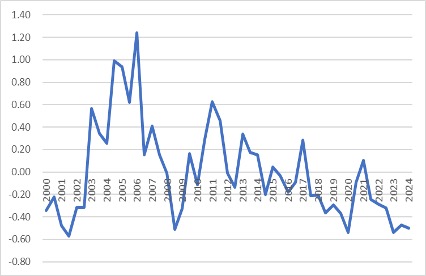

The MM Chinese Art Sentiment Index measures the mood of the market, starting with a mean value of zero. Since the data needs of the sentiment index are not as stringent as for the price index, we start in 2000, dividing each year into Spring and Autumn sales. According to Figure 5, the Chinese art market sentiments can be divided into three periods: Spring 2000 to Spring 2008; Autumn 2008 to Spring 2014; Autumn 2014 to Spring 2024.

In the first period, the sentiment index often exceeded 0.5, thus bidding was quite fierce and artworks were on average sold for 50% higher than average estimates. In the second period – affected by the global financial crisis, the sentiment index fell sharply, and then it gradually recovered. In the third period, the sentiment index fell to new lows in the Spring of 2020 and in the Spring of 2023.

Although the 2024 Spring season showed that the collectors’ confidence recovered a little, market sentiment remained relatively low (Figure 5).

The purpose of constructing the MM Chinese Art Liquidity Index is to measure the liquidity of artists’ works. It consists of three indicators: the number of years when the artist’ works were auctioned during the last 25 years, the sale rate and liquidity, which is the combination of the number of years of auction and the sale rate. According to the liquidity index, between 2000 and 2024, the artists with the most liquidity were Wu Guanzhong, Zao Wou-Ki and Lin Fengmian. (Table 1)

A period of consolidation

The 2024 Spring Auction Index shows that the Chinese art market is still in a period of consolidation, and the downward trend continues, albeit at a slower rate. Chinese art continues to hold long-term investment value. As a physical asset, the artworks should offer an inflation hedge during a period of abundant global liquidity. Therefore, with the development of China’s economy and the growth of worldwide Chinese wealth, we expect that Chinese art will continue to receive strong interest from collectors and investors.

Since the 1990s, China’s auction market for art has developed rapidly. In 2019, more than 680 companies were licensed to engage in cultural artefact and art auctions. The MM Chinese Art Indices have not yet made use of data from Chinese auction houses, which means they only cover a small portion of the Chinese art market’s total trading volume and cannot represent in its entirety the vast Chinese market. When the time is ripe, the MM Chinese Art Indices will cover domestic market transactions, so that they can offer a more comprehensive, objective and accurate overall picture of the state of the Chinese art market.

We hope that the launch of the MM Chinese Art Indices will help provide more information on the Chinese art market. It may provide a measure of the rise and fall of Chinese fortunes around the world. It will enhance market liquidity and help global collectors better understand this market.

Mei Jianping is Professor of Finance at the Cheung Kong Graduate School of Business. His major areas of research include international asset pricing and real asset finance.