Demystifying Bank Risk Sharing Transactions

- Bank Risk Sharing Transactions (RSTs) refers to a strategy whereby a bank can increase its Tier 1 Capital Ratio by transferring some of the credit risk of a portfolio of loans to external, long-term investors.

- The reference assets for RST portfolios may include hundreds, or even thousands, of individual loans to corporates of all sizes, spread across industries and countries, as well as other assets, such as consumer or infrastructure lending.

- RST issuance has surged from an estimated $3.8 billion in 2014 to more than $20 billion last year, with a further increase expected in 2024.

Over the past few months, a great deal has been said and written about the private credit strategy called Bank Risk Sharing Transactions (RSTs), also variously referred to as Regulatory Capital (RegCap) Transactions, Capital Release Transactions (CRTs) and Significant Risk Transfers (SRTs). Global issuance of RSTs has risen from an estimated $3.8 billion in 2014 to more than $20 billion in 2023, with every sign that full-year 2024 will show a further increase.

In the first of this four-part series, we’ll explain in simple terms what bank RSTs actually are. In Part 2, we’ll delve a little deeper into the regulatory regime underpinning RSTs and their importance for the healthy functioning of the European and US banking systems in particular. In Part 3, we’ll consider the economic rationale of RSTs for the issuing banks. We’ll conclude, in Part 4, with key considerations for investors in RSTs.

What are Bank Risk Sharing Transactions?

RST refers to a strategy whereby a bank can increase its Tier 1 Capital Ratio by reducing risk-weighted assets (RWAs). It does this by transferring some of the credit risk of a portfolio of loans to external, long-term investors by buying credit protection in a form approved by its regulator.

What is the Tier 1 Capital Ratio and why is it important?

Banks must hold capital reserves to support the loans they have issued, whether to companies or individuals. This capital acts as a shock absorber, providing a cushion against any unexpected losses arising in a bank’s balance sheet.

One important measure of a bank’s financial strength is the Tier 1 Capital Ratio, also known as the Core Equity Tier 1 Ratio, or CET1. A higher CET1 indicates a stronger financial position. The CET1 is calculated as follows:

Under the Basel III rules, banks must maintain a minimum Tier 1 Capital Ratio. We’ll dive a little deeper into what constitutes “core capital” and into the Basel III regulatory framework in the next part of this series, but suffice to say, the rules are designed to promote stability and trust in the banking system by ensuring that banks have sufficient capital to absorb losses and continue operations during periods of higher stress in the economy.

What risk is actually being transferred?

RSTs transfer credit risk – in other words, the risk of a loan not being fully repaid. RSTs cover only a portion of this risk, typically the first 7%–10% of losses in a diversified portfolio of loans. Any losses in excess of this amount remain with the bank.

The reference assets for RST portfolios come out of core banking activities and often include loans to corporates, from micro-caps and SMEs all the way up to global investment grade (large-cap) companies, as well as other assets, such as consumer or infrastructure lending. A typical RST may contain hundreds or even thousands of individual loans spread across industries and, sometimes, countries. The loans themselves, however, usually remain on the balance sheet of the bank; the credit risk is transferred synthetically.

Because a portion of credit risk is being transferred, it’s important for the investor to understand fully the nature of the underlying assets and not only how they are originated by the bank but also how they are serviced over time. This will be the subject of a later instalment in this series.

How a Bank Risk Sharing Transaction works

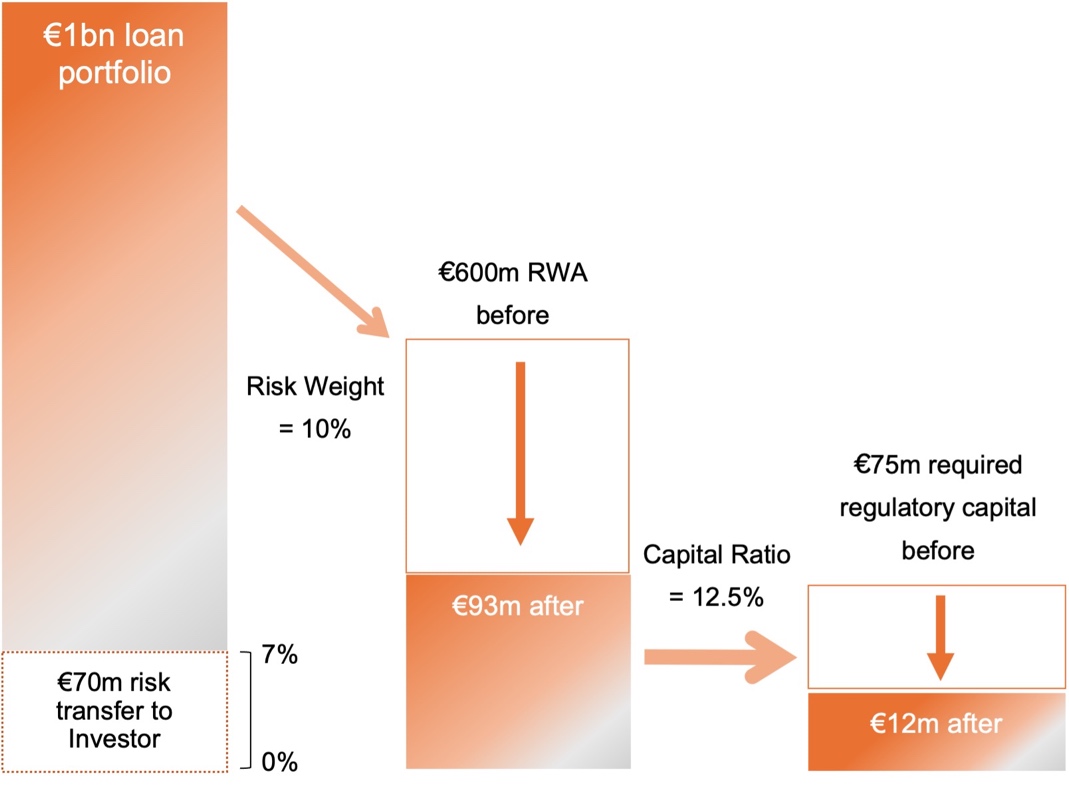

The diagrams below show, in a simplified manner, how an RST can affect a bank’s loan portfolio, risk-weighted assets and required regulatory capital.

Bank capital before RST

This hypothetical bank holds a €1bn loan portfolio. Using its internal ratings, the bank ascribes a 60% risk weighting to these assets, meaning the bank has €600m in risk-weighted assets.

At the required CET1 of 12.5% imposed under Basel III, this bank must hold €75m regulatory capital against the €1bn loan portfolio.

Bank capital after RST

Using an RST, the bank splits the portfolio into a senior (93%) and junior (7%) tranche and synthetically transfers the credit risk of the junior tranche, i.e., €70m, to investors in the RST.

The senior tranche of loans, which is retained by the bank, now attracts a risk weighting of 10%, as opposed to the previous 60%, reducing the level of risk-weighted assets from $600m to €93m.

Now the bank needs to hold only €12m in regulatory capital (i.e., €93m * 12.5%), a savings of €63m. That means €63m has been freed up for other purposes, anything from paying a dividend to shareholders to expanding existing lending.

It’s worth noting that there is no complex structuring involved for either the bank or the investor in reducing the required capital using an RST. The bank and the investor are merely applying the risk weighting regime set by the Bank for International Settlements (BIS) and the capital ratio requirements of Basel III. Banking regulations generally and Basel III in particular will be the focus of the next part in this series on Bank Risk Sharing Transactions.

For more information:

Email: laurie@christoffersonrobb.com