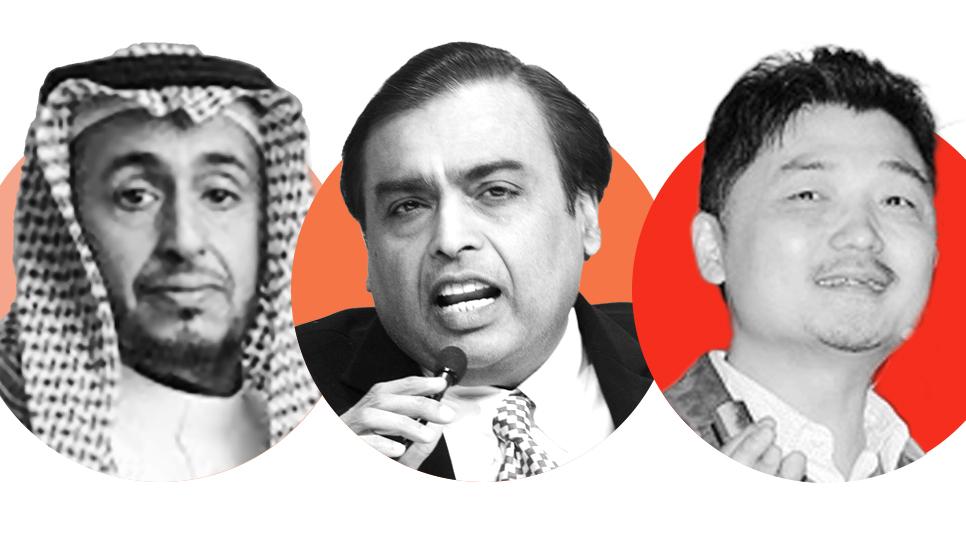

FB Roundup Kim Beom-su, Mukesh Ambani, Al Nahdi Family

Kim Beom-su arrested for stock manipulation

South Korean technology billionaire Kim Beom-su has been arrested for stock manipulation.

The founder of Kakao Corporation, also known as Brian Kim, was arrested for his involvement in a scheme during the high-profile takeover of SM Entertainment in 2023. SM Entertainment is one of South Korea’s largest entertainment companies and has been responsible for the careers of many K-pop stars such as Kangta, BoA, TVXQ, Super Junior and Girls’ Generation.

It is alleged that Kim bought W240 billion ($174 million) of shares in SM Entertainment at an artificially high price specifically to disrupt the rival offer of Hybe. It is said that they drove up SM Entertainment’s share price beyond W120,000 which was the set price at which Hybe was buying shares from the label’s investors.

Hybe is best known for managing the careers of BTS.

Kim denies the allegations but was arrested on concerns by Seoul’s Southern District Court that he was a flight risk and could destroy evidence.

Worth an estimated $3.3 billion, Kim is best known as the founder of Kakao, South Korea’s largest messaging app which is installed on around 90% of the country’s smartphones. He followed that up with the acquisition and listing of Daum, South Korea’s second-largest search engine. A subsidiary of Kakao Entertainment, which was created in 2021, owns and operates a number of film and music studios and also owns Melon, the country’s largest music streaming service.

Ambani’s Reliance Industries plans $500 million loan

India’s largest company Reliance Industries, which is owned by billionaire Mukesh Ambani, is planning to borrow at least $500 million to refinance debt in the group’s first offshore loan this year.

Indian business newspaper Economic Times reports that the group is in talks with a number of foreign banks for a loan of 12-15 years. Funds raised would be used for one of its subsidiaries Ethane Crystal, itself a subsidiary of Reliance Ethane. This is the group’s ethane transport business.

The last time that the subsidiary raised money in the international capital markets was in 2016 with a $572 million 12-year loan. Funds were used to acquire six new ethane carriers.

Greater investment in ethane should not be a surprise. In mid-July, giving its half-year results, Reliance confirmed that “margins were partially supported by year-on-year lower ethane prices”. A slightly longer tenor on the new loan will help the conglomerate maintain its competitiveness.

Several weeks ago we reported on the wedding of Ambani’s youngest son Anant Ambani and Radhika Merchant in Mumbai.

With an estimated net worth of $113.7 billion as of March 2024, Mukesh Ambani is the richest person in Asia and the 11th richest in the world, according to Forbes magazine.

Al Nahdi Family backs GII

Saudi Arabia’s Al Nahdi Family has backed Dubai-based Gulf Islamic Investments (GII) as the group raised $100 million from investors to support an expansion plan in the region.

GII, a Shariah-compliant financial services company, manages around $4.5 billion in assets and has been looking at deals in the medical and logistics sectors across the kingdom and the broader Gulf region.

In January, GII invested $160 million in Saudi health-care provider Abeer Medical Company and in 2022 it took a majority stake in Al Meswak Dental Clinics, one of the largest providers of dental and dermatology care in Saudi Arabia.

The Al Nahdi Family Office was established in 2019, by the founding family patriarch, Abdullah bin Amer Al Nahdi. In 2022, it listed its flagship holding Nahdi Medical in what remains one of Saudi Arabia’s largest initial public offerings to date. The family maintains a 35% stake in the group.

The group started in 1986 as a single pharmacy. It now covers logistics, transportation, education, catering, clean energy, as well as artificial intelligence.

The company has multiple partnerships, including with the Centre for Strategic Philanthropy, the KPI Institute, EY, SEDCO Holding, and Credit Suisse.