The aspirations of Johnny Hon, entrepreneur in philanthropy

Johnny Hon, founder and executive chairman of venture capital firm Global Group International Holdings, has pursued success in business as a route to giving back. He explains why philanthropy is important to him and what he has learnt along the way.

When it comes to investments, Dr Johnny Hon is a master. From art and wine collecting and movie financing, to owning champion racehorses and investing in innovative tech, the founder of the Global Group has made a career turning his passions into successful investments.

But it could all have been so different for Hong Kong-born Hon who, as a student, was happily paving his way towards a career in medical research, having graduated from King’s College London with a biomedical science degree. It was while studying for his PhD in psychiatry at Cambridge University, however, that Hon realised he wanted to pursue a career that could finance his love of philanthropy.

“Whilst studying I knew I wanted to give back in a serious way,” he says.

“I came to realise that, for my own skills and abilities, the most effective way to help more people was as a businessman, rather than as a doctor or a scientist, because if I was successful, I would be able to commit far greater resources to worthy causes close to my heart.”

Hon instead became a private banker, developing expertise in financial planning, lending, and portfolio management. It led him to form The Global Group International Holdings in 1997, which has grown into an international conglomerate, providing corporate financial advice and boutique investment-banking services. The Global Group also raises funds to support innovative enterprises at every stage of development, from startups, right through to initial public offerings (IPO).

Hon instead became a private banker, developing expertise in financial planning, lending, and portfolio management. It led him to form The Global Group International Holdings in 1997, which has grown into an international conglomerate, providing corporate financial advice and boutique investment-banking services. The Global Group also raises funds to support innovative enterprises at every stage of development, from startups, right through to initial public offerings (IPO).

But growing his business could have been a shallow endeavour if it didn’t have a higher purpose, Hon admits. The group’s success has ultimately allowed him to not only indulge and invest in his passions, including the entertainment industry and racehorses, but to give back to society.

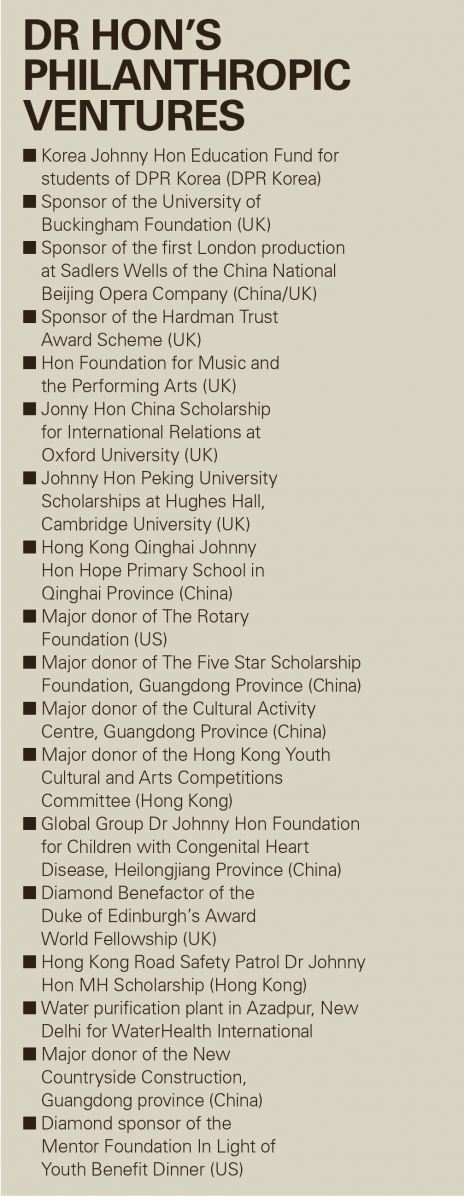

Since 2004, Hon has funded scholarships, set up numerous foundations and donated to charitable projects. He has also served in senior management and advisory positions for 30 major charities. In the UK, the Global Group works with the Duke of Edinburgh fellowship, and with Oxford University in donating scholarships. In China, they help children with congenital heart disease and Down’s syndrome.

Since 2004, Hon has funded scholarships, set up numerous foundations and donated to charitable projects. He has also served in senior management and advisory positions for 30 major charities. In the UK, the Global Group works with the Duke of Edinburgh fellowship, and with Oxford University in donating scholarships. In China, they help children with congenital heart disease and Down’s syndrome.

And he’s looking to do more. With business thriving at Global Group, Hon wants to reinvest more of his earnings back into the community.

“My philosophy was that by getting into business, I could make more money and help more people, so philanthropy is an important part of this process,” Hon says.

“We’ve donated to more than 180 charities worldwide and half of the money we’ve made goes towards helping charities internationally.”

“One other way that I choose the areas I want to support, another is attending networking events. These events marry up business and social responsibility, and as such they are a great resource for meeting people with incredible stories to tell and projects to promote.”

Which project are you most proud of?

Which project are you most proud of?

“It is impossible to rank my philanthropic projects, as each fills me with great pride, and I am involved in a huge range of activities and causes around the world.

“However, a recent project that is particularly close to my heart is my support of WaterHealth International. Two years ago, I donated a water purification plant in Azadpur, near the Indian capital New Delhi, to support the work this exceptional socially responsible company does to aid economically poor and socially disadvantaged groups.

“This is perhaps the perfect example of how my work and philanthropy are intrinsically linked. I am passionate about East to West commercial relations, and specifically about raising awareness of the manifold opportunities there are to collaborate with rapidly developing major economies like India.”

What types of projects are you looking to focus on in the future?

“Increasingly, I am looking to invest in sectors that serve a humanitarian goal: to safeguard the future of generations to come.

“As a father of four young children, I want to make sure my investments do not contribute to the ever-looming threat of climate change or the reckless depletion of finite resources.

“In 2019, I am particularly focusing on so-called impact investments—investments with ethics running through their core. This ranges from supporting the biotechnology space and considering how technology such as artificial intelligence (AI) can further scientific discoveries.

“In the UK, for example, AI is already being used to support the health service in areas as diverse as early-stage cancer detection, to remote operations, or providing a second insight into radiology scans.”

“This is just one example of how philanthropy in its purest sense—the desire to promote the welfare of others—is present throughout all of the work I do.”

“This is just one example of how philanthropy in its purest sense—the desire to promote the welfare of others—is present throughout all of the work I do.”

What are the common misconceptions about philanthropy?

“A misconception among philanthropists, which I often tend to encounter, is the belief that the more projects that you are involved in, the better.

“Personally, I prefer a more measured and reasoned approach to truly get the greatest benefits out of my philanthropic work—taking the time to pick a project with a purpose that you are passionate about will make for a better outcome.

“Philanthropy is a big-picture concept: it has to be a commitment to the greater good and is not simply a project that you can see from start to finish in a short time span. It is something that could last for many years before it is completed. Indeed, it may never reach completion.”

What advice do you have for family business leaders looking to give back?

“Ultimately, our primary objective must be to make the world a better place, and that’s why investing in the future is of the utmost importance—this is the guiding principle of all my philanthropic activities.

“Ultimately, our primary objective must be to make the world a better place, and that’s why investing in the future is of the utmost importance—this is the guiding principle of all my philanthropic activities.

“It is important to remember that philanthropy is not just a numbers game. Instead investors must choose to support causes where they believe they can truly make a difference.

“It is important to remember that philanthropy is not just a numbers game. Instead investors must choose to support causes where they believe they can truly make a difference.

“The best way to do this is to match up your passions and expertise with your charity of choice. Much of my philanthropy relates to my personal life experiences and professional career.

“My work has taken me on visits to countries like South Sudan and Armenia and allowed me to explore economic development initiatives, whilst also providing support first hand to help disadvantaged communities.

“I always recommend investors get hands-on with the charities they support—for me, there’s no better way to measure the success of philanthropic efforts than by being on the ground. It also allows you to see the positive impact of your investment on the frontline.

Which areas do you believe need more philanthropic investing from families?

“There is a huge need for additional impact investment in new technologies, such as biotechnology, green technology, and agricultural technology. There are currently over seven billion people living in the world, and this number is expected to increase by a further two billion by 2050.

“Families with charitable foundations, or those looking for their next philanthropic investment, could certainly consider investing in ways to help counteract a potential crisis of food and water supply as these options will give back, improve quality of life, and benefit many generations to come.

“Families with charitable foundations, or those looking for their next philanthropic investment, could certainly consider investing in ways to help counteract a potential crisis of food and water supply as these options will give back, improve quality of life, and benefit many generations to come.

“Population growth will create significant global challenges, whether they be environmental or in terms of access to quality education and healthcare.

“Impact investing will be vital to business and ultra-high net worth and high net worth families and individuals should consider how they could interlink their business and philanthropic interests here.

“Investment in these emerging technologies may help to provide cures for diseases such as heart disease, cancer and diabetes—which will have a tremendous impact on quality of life, mortality rates, and the entire society.”

Where do you believe philanthropy is heading in the future?

“I think the extraordinarily fast pace at which technology and the needs of society are developing and evolving will have a huge influence in shaping the future of philanthropy.

“I think the extraordinarily fast pace at which technology and the needs of society are developing and evolving will have a huge influence in shaping the future of philanthropy.

“Entrepreneurs who understand the impact and role of such new technology can increasingly fill the social gaps that exist, as governments alone cannot cope with this rapid pace of change.

“I believe government focus should be on maintaining traditional sectors such as education and health, while entrepreneurs can use their skills to undertake projects where there is more risk involved and where creative solutions are needed to help people in need.

“For example, Bill Gates is currently engaged in a project to find the right vaccine for HIV, where I believe governments would not have the necessary skills to drive this kind of work as effectively. Ultimately, I think that successful businessmen and women will contribute more and more to philanthropy and become the backbone of giving for future generations.”