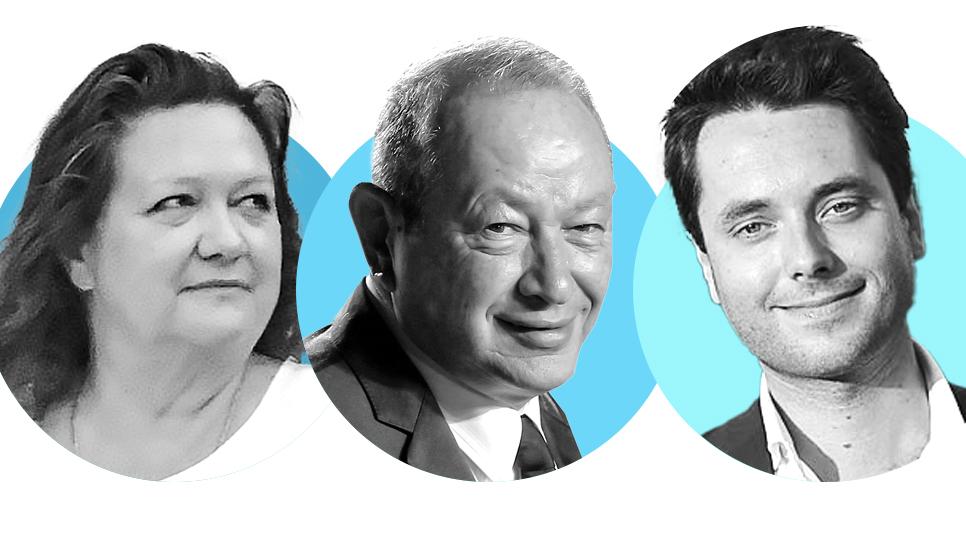

FB Roundup Gina Rinehart, Naguib Sawiris, Rodolphe Frerejean-Taittinger

Gina Rinehart’s war with the National Gallery of Australia

Australian mining billionaire Gina Rinehart attempted not only to remove two portraits of her from the National Gallery of Australia but to have them destroyed.

The portraits are by Vincent Namatjira, an award-winning Aboriginal Australian artist living in Indulkana, in the Anangu Pitjantjatjara Yankunytjatjara in South Australia, and were part of his solo “Australia in Colour” exhibition that had opened at the gallery.

The show was well-reviewed. Time Out said: “His satirical swipes at everything from the British royals to former President Trump are delicious, as are his empowered depictions of homegrown heroes”.

Freedom of information documents obtained by The Guardian show how the mining magnate lobbied the National Gallery chair over the Namatjira portraits. She demanded not only that the portraits be removed, but that they be “permanently disposed of”.

Despite additional pressure from the government and the museum’s board, the pictures were not removed.

Rinehart is known for her pugnacious nature. She has been locked in a prolonged legal battle for years with her children, John and Bianca, over the ownership of mining assets belonging to their grandfather – Gina’s father.

As we reported earlier this year, Rinehart further added to her portfolio of mineral producers vital to the energy transition in April, with the acquisition of an almost 6% stake in Lynas Rare Earths. Rinehart’s private company, Hancock Prospecting, added 6.6 million shares in the Sydney-listed company for more than A$40 million ($25.7 million), according to a filing.

Forbes estimates that she is worth an estimated $31.6 billion. The daughter of iron ore explorer Lang Hancock, Rinehart rebuilt her late father's company, Hancock Prospecting, and became executive chairwoman in 1992. She has made significant investments into rare earth minerals and the gas sector. She is also Australia's second-largest cattle producer, with a portfolio of properties across the country.

Naguib Sawiris warns of property slowdown in Egypt

Naguib Sawiris, Chairperson of Ora Developers Egypt, announced that his company had delivered the first phase of the ZED Sheikh Zayed project without making any profits.

He warned last week that although his company had delivered the first phase of the ZED Sheikh Zayed project, thanks to rising inflation and depreciation of the Egyptian pound, he has not made a profit.

Earlier this year, the Egyptian pound fell more than 60% against the US dollar after the central bank simultaneously unpegged its currency and raised interest rates by 600 basis points in an attempt to stabilise the economy. It was prompted to do so on the demands of the IMF.

Located in the heart of El Sheikh Zayed city in Western Cairo, close to the main road AlNozha Rd as well as the 26th of July Corridor and Alex Desert Rd, Zed El Sheikh Zayed is a 693,000 square metre plot of real estate with 4,700 residential apartments as well as 37,100 square metres of commercial space and 77,100 square metres of offices surrounding ZED Park.

Thanks to a 30% rise in interest rates, Sawiris said that high rates negatively affect developers’ ability to deliver projects on time as promised to customers.

Although he remains broadly optimistic about the real estate sector, Sawiris toldDaily News Egypt that there were dangers here both for the government and developers. He said: “We, as a company, are working carefully to avoid falling into this situation and will not tell our competitors what they should do.”

In the latest construction update, Sawiris said that 70% of the project was complete.

Naguib Sawiris is worth an estimated $3.8 billion according to Forbes. He built a fortune in telecoms famously selling Orascom Telecom to Russian telco VimpelCom (now Veon) in 2011.

Taittinger family split on move into low-alcohol wines

Rodolphe Frerejean-Taittinger, great-grandson of the champagne house founder Pierre Taittinger, and the nephew of Pierre-Emmanuel Taittinger, current chairman of the group, has won the backing of rival Moët & Chandon to create alcohol-free sparkling wines.

Founded by Rodolphe’s wife Maggie Frerejean-Taittinger together with French model Constance Jablonski and with Rodolphe as chief executive, French Bloom was set up to create alcohol-free sparkling wines with a combination of Chardonnay and Pinot Noir grapes.

Philippe Schaus, Moët Hennessy chief executive, toldThe Daily Telegraph that the company’s investment in French Bloom demonstrated “our commitment to offering high-quality, alcohol-free choices to consumers who moderate their alcohol intake”.

The precise sum that he has invested has not been disclosed.

In the same interview, a spokesman for French Bloom said: “The company’s commitment is solely to innovation and quality in the non-alcoholic sparkling wine sector, focusing on establishing a distinct identity and superior products in the market, separate from any ties to Taittinger Champagne.”

Pierre-Emmanuel has long opposed any move into low-alcohol wine production. The third-oldest Champagne house, Taittinger produces a total of more than 400,000 cases annually of several different cuvées.

In 2019, Pierre-Emmanuel announced that his daughter, Vitalie Taittinger, would replace him as president of the champagne house in January 2020.

The Taittinger family's net worth has been estimated at $3.4 billion. Company accounts show that in 2022 the champagne business made net profits of more than €37 million. After an unwise sale to private equity firm Starwood Capital Group in 2005 because of tax problems, it was bought back by the family in May the following year.