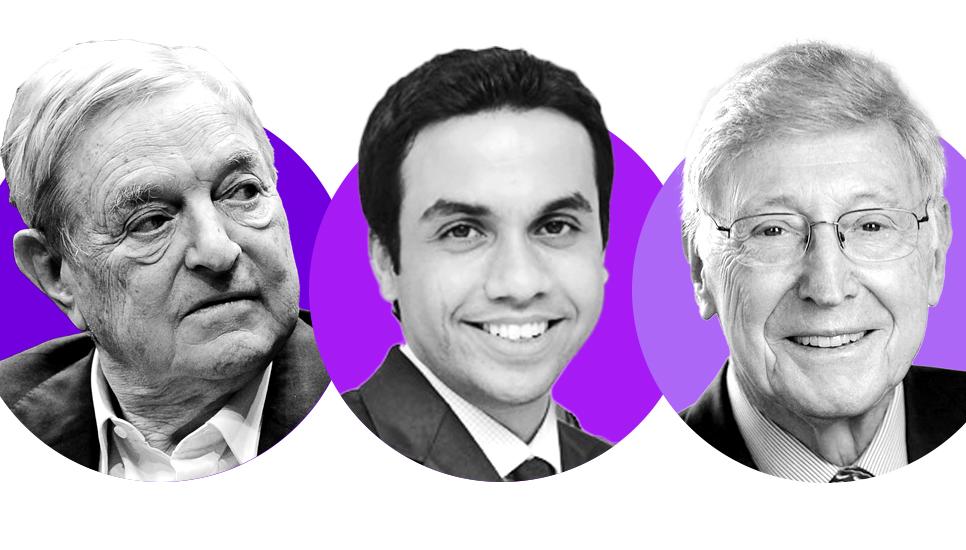

FB Roundup George Soros, the Godrej family, Bernie Marcus

George Soros closes office in Hong Kong

Hedge fund tycoon George Soros has said that he will close his fund management office in Hong Kong. Although Soros Fund Management has said that the office will close, he has confirmed that he does not intend to withdraw from Asia.

Following the closure, investments in Asia will be overseen from its New York and London offices, writes Bloomberg.

Founded in 1970 by Soros, the firm says that it invests globally in a wide range of strategies and asset classes, including public equities, fixed income, commodities, foreign exchange, alternative assets and private equity.

The firm’s Hong Kong office opened in 2010. At its peak in 2011, it had 20 Hong Kong-licensed employees, according to Webb-site.com, which compiles such information from official regulatory data. However, Soros is known to be bearish about investments in China. In September 2021, Soros in an op-ed for the Wall Street Journal, said that “pouring billions of dollars in China now is a tragic mistake”.

Born in Hungary, Soros left the country at the age of 17 and put himself through the London School of Economics working as a railway porter and waiter.

In 1992, he shorted the British pound and made a reported profit of $1 billion. As a result, he became known as the man who broke the Bank of England. A few years later, he earned almost $1 billion by February 2013 betting that the Japanese yen would fall.

Since 2018, his efforts have been mostly focused on his Open Society Foundations. It is now “the world’s largest private funders of independent groups working for justice, democratic governance, and human rights”.

Forbes estimates that Soros’ net worth is $7.2 billion.

Propsoch raises funding supported by Godrej family

India’s Propsoch, which offers home-buying services including property management, interior design, legal home consultations, and home loan services, has raised $500,000 in a pre-seed funding round led by the family office investment arm of the Godrej Group.

The funding will support Propsoch’s growth in the Mumbai and Pune markets, alongside enhancing operations in Bengaluru.

Co-founded by Ashish Acharya and Ravi Agrawal, Propsoch hopes to address transparency issues in India’s real estate market and help homebuyers make informed decisions. “Our goal is to address the information gap for homebuyers, providing clarity in an often opaque process,” says Acharya.

India’s proptech sector has been growing, driven by a demand for efficiency and transparency in real estate. According to DART Consulting, the industry is growing at around 12% between 2023 and 2027. Funding exceeded $4 billion in 2023 alone.

Godrej Properties’ executive chairman Pirojsha Godrej noted that the company’s data-driven approach complements Godrej’s emphasis on transparency and consumer-centric solutions.

“Propsoch’s vision aligns perfectly with our belief in data-driven, transparent solutions that benefit end consumers,” he said.

Worth an estimated $16.7 billion according to Forbes, the Godrej family controls the Godrej Group, one of the country’s largest consumer and industrial products companies.

Established by Ardeshir Godrej in 1897, the current head of the family is Adi Godrej who took over in 2000.

Home Depot’s Bernie Marcus dies

Bernie Marcus, founder of American multinational home improvement retail corporation Home Depot, has passed away at the age of 95.

Born in 1929, he grew up in a tenement in Newark, New Jersey. Marcus dreamed of becoming a doctor. When his family couldn't afford medical school, he enrolled in pharmacy school and received a degree from Rutgers University.

After college, he worked his way up the corporate ladder at manufacturing conglomerate O’Dell’s and retail chain Vornado. By 1972, Marcus was the chairman and president of Handy Dan Improvement Centers, a chain that was part of the Daylin conglomerate. While working there, he formed a friendship with Arthur Blank that would last for the rest of his life.

The watershed moment in Bernie’s career came when he was fired from Handy Dan in April 1978, along with Arthur and Ron Brill. Bernie was faced with the prospect of reinventing himself at 49. He already had a vision of a one-stop shop for do-it-yourselfers, something that did not exist in the home improvement retail landscape at the time. Investment banker Ken Langone helped secure the financing to get The Home Depot started.

The following year, the first Home Depot stores opened in Atlanta. By 1990, Home Depot grew into the largest home improvement chain, eventually employing 500,000 workers. In 2002, Marcus retired as one of the richest people in America.

“Bernie was an inspiration in many ways. He was a master merchant and a genius with customer service. Together with Arthur Blank and Ken Langone, Bernie helped create a nation of doers who could tackle any project, large or small. He loved our customers. He also loved the associates who made the company what it is today,” said Home Depot in its obituary.

Known in his later years for his philanthropy, he gave away almost $2 billion to education, hospitals and Jewish causes in his lifetime.

According to Forbes, his net worth was $10.3 billion.