FB Roundup: Godrej Group, Crown Resorts, Exor

Godrej family set to divide $4.1 billion empire

Godrej Group, the $4.1 billion family-controlled empire that declares it positively impacts the lives of one-third of India’s population every day, looks set to be amicably split between two branches.

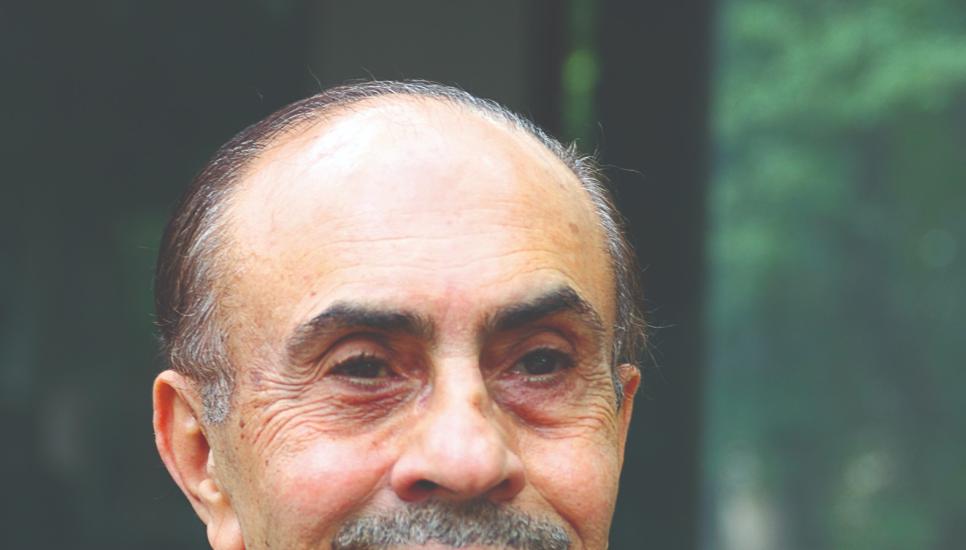

The fourth-generation families of patriarch Adi Godrej (pictured left), 79, and his younger brother Nadir Godrej (pictured below), 70, are working on dividing the 124-year-old diversified group with their cousins Jamshyd Godrej, 72, and Smitha Godrej Crishna, 71, insiders reported.

The split of one of India's largest consumer and industrial products companies has been in progress for years. However, the reorganisation has accelerated in the past few months, with Adi Godrej’s son, Pirojsha Godrej, 41, representing his father and uncle’s side of the family opposite Jamshyd Godrej, with Purvez Kesri Gandhi, the chief financial officer of Godrej & Boyce, the privately held flagship company of the Godrej Group, plus external legal and financial advisers. The split was speculated to be resolved in the next six months.

Despite a capable rising next generation, Adi Godrej did not name a successor when CampdenFB asked the septuagenarian billionaire about his succession plan in 2011. After more than four decades, Godrej stepped down as both chairman and director from the board of the group’s holding company Godrej Industries in August 2021. He continues to serve as chairman of the Godrej Group and chairman emeritus of Godrej Industries. His brother Nadir Godrej, already managing director of Godrej Industries, took over both vacated roles on the board from 1 October.

Despite a capable rising next generation, Adi Godrej did not name a successor when CampdenFB asked the septuagenarian billionaire about his succession plan in 2011. After more than four decades, Godrej stepped down as both chairman and director from the board of the group’s holding company Godrej Industries in August 2021. He continues to serve as chairman of the Godrej Group and chairman emeritus of Godrej Industries. His brother Nadir Godrej, already managing director of Godrej Industries, took over both vacated roles on the board from 1 October.

Their 19th century ancestor, Ardeshir Godrej, was a lawyer-turned-serial entrepreneur, who failed with a few startups before finding success with an innovative patented lock-making venture. He established what became the Godrej Group with his brother Pirojsha Burjorji Godrej in 1897.

The Mumbai-headquartered group now employs 14,000 staff members and serves 1.1 billion consumers globally across 10 industries, including consumer goods, real estate, appliances and agriculture. The company’s products are sold worldwide through international subsidiaries and joint ventures. About 23% of the promoter holding in the Godrej Group is held in trusts which invest in the environment, health and education.

James Packer admits ‘oversights’ and should have quit Crown Resorts

James Packer admits ‘oversights’ and should have quit Crown Resorts

Australian billionaire heir James Packer has admitted “many oversights” in his absence from board meetings at the Perth casino within the Crown Resorts chain he founded.

Packer (pictured), 54, son of the late media mogul Kerry Packer (pictured below), inherited his family’s private investment company Consolidated Press Holdings, which maintains a majority 37% stake in Crown. However, Packer departed Australia in 2013 and resigned from corporate roles at the $5.3 billion Crown company in 2018, citing mental health issues.

His absence and its consequences were aired in a public hearing into Crown’s fitness to keep its casino licence in Perth in the wake of alleged money-laundering activities. The inquiry in Western Australia last month followed similar state inquiries held in Melbourne and Sydney earlier in 2021.

The reclusive billionaire gave evidence to the royal commission in Perth via video link from an undisclosed location, his first public appearance in a year.

Burswood Ltd, chaired by Packer, was Crown’s Western Australian subsidiary that held the licence for the Perth casino in 2004-16. However, under questions, Packer agreed he had not attended any Burswood board meetings after leaving the country in 2013.

He received updates on operations from Crown while overseas, but there may have been misunderstandings among directors about their duties as there was no charter.

“There is no doubt I should have attended or resigned,” he reportedly told the hearing.

Asked if any board member during his time as chair had been appointed with financial crime risk experience, Packer said he did not believe there was.

“Looking back there are many oversights, things that should have been done differently. I did not believe at that point in time that Crown Perth was engaged in money laundering.”

The previous state probes recommended Crown be reformed under strict conditions rather than stripped of its casino licences. Packer did not object to the Victorian inquiry’s call for him to sell down Consolidated’s shares in the group to 5% or less by September 2024.

The Western Australian inquiry was expected to deliver its verdict in March 2022.

Luxury-leaning Exor to sell PartnerRe to Covea for $9 billion in revived deal

Luxury-leaning Exor to sell PartnerRe to Covea for $9 billion in revived deal

Exor, the $136 billion holding company of Italy’s Agnelli family, is back on track to sell its PartnerRe re-insurer to French insurance group Covea for $9 billion, a year after the deal was derailed by Covid-19.

Covea pulled out of talks with Exor to buy its wholly owned PartnerRe for $9 billion last year, saying it could no longer buy the Bermuda-based firm under the terms of their agreement, which was signed before the pandemic. However, Exor announced in late October a memorandum of understanding between Exor and Covea for the sale at the original price tag.

The reinsurance and investment cooperation agreements between the three parties in August 2020 resulted in an “even greater appreciation by Covea of the shared culture with PartnerRe of customer service excellence, deep technical expertise and underwriting discipline,” Exor said.

The agreements facilitated a close cooperation between the PartnerRe and Covea executive and operating teams which helped resuscitate the deal.

Exor is chaired by John Elkann (pictured above), 45, an Italian American grandson of Fiat chairman Gianni Agnelli.

Exor is chaired by John Elkann (pictured above), 45, an Italian American grandson of Fiat chairman Gianni Agnelli.

“The cooperation agreement signed in the summer of 2020 with Covea has been positive in many ways and has contributed to a strong level of mutual trust between our companies,” Elkann said.

“Also, thanks to Jacques Bonneau’s leadership and the excellent work of his team, PartnerRe has further improved its performance and strengthened its distinctive capabilities.”

The proposed transaction was expected to be completed in mid-2022. Attention will turn to what Exor does with its $9 billion cash injection, with further investment in the luxury sector considered likely.

Exor announced last month a multi-year partnership with former Apple designer Sir Jony Ive and his business partner Marc Newson, and Ferrari, the sports car maker held by Exor.

In July, Elkann reportedly proposed to buy a minority stake in the $7.09 billion Milanese fashion house Armani, which is entirely owned by its founding designer Giorgio Armani (pictured above), 87. Exor told Reuters it had not approached Armani and the Armani company did not comment.